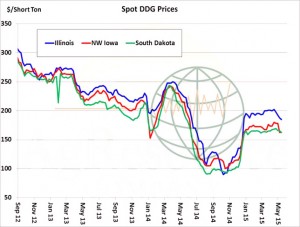

- News that China has started to slow their imports of US DDGs due to their own oversupply of feed-grains and Government cajoling to halt/slow imports by state and private buyers is starting to pressure US prices. US DDG prices have turned down amid reduced export demand which is starting to allow it to compete more effectively with soymeal. We expect that China could import 150-200,000 mt per month, but this is well below the 500,000 mt plus of prior months.

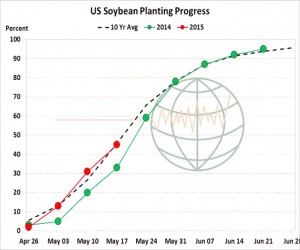

- In the US the weather continues to lean bearish for soybeans as NASS reported planting progress through Sunday at 45% complete against 31% last year and the 10-year average of 37%. Active rainfall in the Western corn belt and to the North may keep planting slow this week but should pick up in the East. The above average pace of planting will provide a cushion for any weather delays, whilst the current wet conditions will likely add more soybean acres instead of corn in small areas of North Dakota and Minnesota.

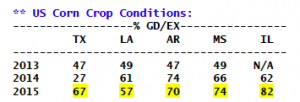

- US corn seeding as of Sunday reached 85% complete, up 10% on the week and compared to the 10-year average of 78%. We expect planting to reach 94-96% in the next 7 days as fieldwork resumes across the Midwest and N Plains. Planting will continue across IL, IN, OH and KY this week, leaving only the C Plains lagging. Note also that conditions have been released from select states, which are displayed below. Conditions across the Delta/Southeast are steady with year-ago levels, while good/excellent conditions in TX and IL are well ahead of last year. Nationally, the crop is 56% emerged and US crop conditions will be released next Tuesday. We expect national good/excellent ratings in a range of 75-80%. Confirmation of high crop ratings next week should trigger a pre-pollination low of $3.50, basis July. Dec above $3.95 is a selling opportunity in our opinion, with a more dire weather threat needed to sustain a recovery above $4.00 Dec into mid to late June.

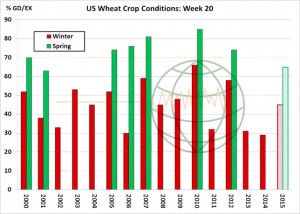

- US winter wheat conditions were pegged at 45% good/excellent, vs. 44% last week and 29% a year ago and the 10-year average of 45%. Notable improvement was recorded across the PNW, KS and MI, with each up 2-4% points. Little change is noted elsewhere. Initial spring wheat ratings, which have been released much earlier than normal – rest at 65% good/excellent, a bit lower than expected. Warmer weather in late May will likely trigger an improvement. Another 1-4” of rain is scheduled for TX and OK in the next 6-7 days, after which a more lasting period of dryness develops. Quality will be a more serious issue if lingering precipitation continues in June, but it’s much too early to quantify quality losses, if any, just yet. It is worth noting that as far as the US is concerned this is also a moot point without improved export demand.

- Today has seen some pressure returning to CBOT prices as a stronger US$ and favourable weather forecasts for this week’s seeding cap recent gains. July ’15 soybeans have broken below $9.50/bu and July ’15 corn appears to be targeting $3.50/bu. Recent fund buying in July ’15 wheat appears to be slowing and we have seen a downward price correction, a close below $5.00/bu basis July ’15 futures would likely produce a test of the contract lows. We continue to doubt that seasonal lows have yet been seen.

- Today saw the USA announce an old crop soybean sale to China (132,000 mt), which the trade does not expect to see shipped until a new crop position. Strategic Chinese purchasing to support old crop prices may well be a driver of the reported trade.

- Interestingly, for us in Europe, despite another 200 point drop in the €uro, Matif wheat fell €2 mirroring Chicago. It would be logical to conclude therefore that Paris wheat is currently trading as a function of its transatlantic cousin rather than on its own merits.

- As a final comment, US wheat quality issues will not be resolved until harvest, but it should not be forgotten that there is still no shortage of wheat in the world and despite a $25 rally in Chicago, Black Sea prices are up a more modest $5, and that is despite removal of the Russian export tariff!. In corn, US demand continues to be the issue, domestic (avian influenza) or exports (cheaper non-US supplies). DDG supplies do not assist the position either. With little in the way of weather risk (right now) and a potential increase in acres in the June USDA planting report, and the Brazilian crop coming to market in around ten weeks it seems that the bulls are struggling for a story right now. Nov ’15 soybeans broke and closed below last September’s contract lows, but the recent weather (slowdown of planting) and Argentine uncertainty held the market – until today. Last week’s USDA US end stock figures were all above “analysts” estimates, but this was shrugged off as the USDA is “always underestimating demand in May”! It may well be that we have to get to the June report, where it seems that there is a growing consensus that soybean acres could well grow by 2 million before we see the market really take a break on its next leg lower.