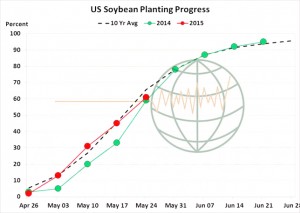

- Yesterday’s US condition and planting report showed soybean planting to be 61% complete compared to 45% last week and 55% last year while the 10-year average for this time of year is 58%.

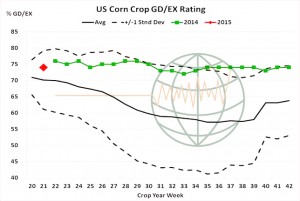

- Corn planting was 92% complete compared to 85% last week and 86% last year while the 10-year average for this time of year is 88%. Traders were looking for the weekly crop condition update to show 75% of the crop in good to excellent condition, and the report showed 74% was rated good/excellent. The 10-year average for this time of year is 71%. The highest percent rated good/excellent was 78% in 2007 while the lowest was 63% in 2005.

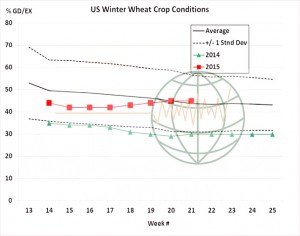

- Winter wheat rated as good/excellent stood at 45% unchanged on last week and compared to 30% last year while the 10-year average for this time of year is 45%. The weekly spring wheat planting report showed the crop to be 96% complete compared to 94% last week and 70% last year while the 10-year average for this time of year is 83%. The conditions report showed 69% was rated good/excellent compared to 65% last week and the 10-year average for this time of year at 78%.

- The market may well have been expecting a reversal of yesterday’s decline on profit taking but favourable central US and world weather has put paid to that – today as grain markets closed lower once again. July ’15 corn has moved closer to the $3.50 support level whilst July ’15 wheat clearly has its eye on the early May lows once again. Soybeans and meal found a degree of support on the Argentine strike and associated cash firmness which is evident particularly in EU soybean meal premiums – but the market is lacking any convincing demand as Chinese demand slows as evidenced by lack of new purchases and open export slots in Brazil through late May and June (which is historically unusual).

- Matif wheat again closed lower with the Sep ‘15 displaying a drop of up to €8 from last Friday’s high. This, coupled with a slump of some 5% in the €uro has seen FOB values in France drop by a staggering €15 in under a week.

- All in all, we are asking the question, “How low is low when it comes to prices?” Buyers are not showing their hand, when they do there is a rush of sellers (trade not farm) and it feels very much as if the buyer has, and will retain, the upper hand for the time being.