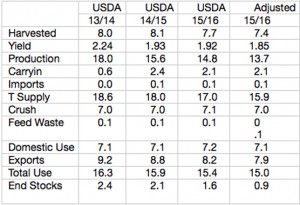

- Canadian Canola futures have rallied to yearly high with a noticeable push seen in the last week. Canola stocks were already tightening amid slightly higher than expected crush and lower expected new crop planting intentions. The EPA’s proposal for higher biodiesel blending, and recent frost/freeze damage have exacerbated the rally. We have adjusted harvested area and yield to levels slightly below the USDA’s forecast in May due to a late May frost. Notice how sensitive Canada’s canola balance becomes for 2015/16! Harvested area is projected at 7.4 million ha, down 300,000 from USDA. Yield is pegged at 1.85 mt/ha, down 4%. Yet stocks will be nearly halved and a supply rationing rally is unfolding. Our adjusted balance sheet features Canadian canola stocks/use of 5.8%, vs. 13% in 14/15 and record low stocks/use of 4.2% in 2012.

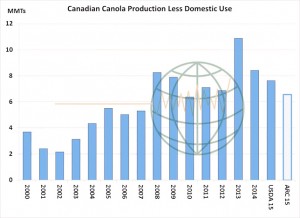

- Our 13.7 million mt production estimate is 6.6 million mt above total domestic use – which is projected to be flat in 14/15 – and this surplus will be declining for a second consecutive year. The market will have to slow exports, and still drawdown ending stocks to a three-year year low. We peg Canadian canola ending stocks at 875,000 mt, down 750,000 from the USDA’s 15/16 forecast and down 1.2 million mt from a year ago. Assuming steady crush and feed disappearance, Canadian canola exports will be capped at 7.9-8.0 million mt, down 1.3 million mt from the peak of 2013. Note also that world canola stocks will be in decline amid the loss of Canadian and EU supply, with global 2015/16 canola stocks/use estimated at 6.2%, vs. 10% in 2013, the lowest total since 2003. The canola balance sheet is an island of supportive vegoil support.

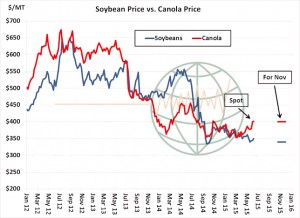

- The market is already sending the signal for end users to seek alternative vegoil supplies. The graphic below charts US soybeans and Canadian canola prices in US$/mt, and the canola market has develop a premium to soybeans rather quickly. This is far different from what’s been witnessed in the last two years. Spot canola is priced at a $52/mt premium to soybeans, and an even steeper $61/mt for autumn delivery. There’s no shortage of North American or global oilseeds/products, but how it gets distributed will affect inter-commodity spreads. We expect sub-$9.00 soybean futures to weigh on canola, but hefty premiums will be paid for canola over the course of the 2015 marketing year. Stats Can will update Canola acreage on 30 June with initial production due in mid-August.