- In a broad sense, the USDA June NASS and WASDE reports held few surprises! Traders will now look to the NASS June 30th Stocks & Seeding report and US/world weather for price direction. It’s all a question of new crop supply. The June Stocks report will likely report a sizeable rise in US corn and soybean end stocks from prior years, but it is seeding changes that will garner all of the market attention. Will 2.4-3.2 million acres of Prevent Plant acres get seeded this year when compared to 2014? It has been a nice spring for seeding across much of the Central US (except for KS/MO). Even in the Plains, producers tell us that they are going to utilise all of the soil moisture and seed additional acres to sorghum/soybeans. Sharp falls in 2015 US corn, soybean or spring wheat seeding are not expected to be uncovered on June 30th. If there was a surprise in the June WASDE report it was that 2015/16 US biodiesel demand was not raised substantially! WASDE estimated 15/16 US biodiesel use at 5,100 million pounds, a 2% increase from May. Such an increase, with WASDE having time to fully analyse the impact of the new EIA RFS proposal, was disappointing. Such a soy oil production increase would only require an additional 8.7 million bu of soybeans! Also, Black Sea and European total 2015/16 wheat supplies will be equal to or above last year. There will be no shortage of world wheat with major world exporters all competing for trade that is not any larger than 2014/15. For a lasting trend change in world/Chicago grain/soy prices requires adverse weather. Normal weather will produce a grind lower into late July.

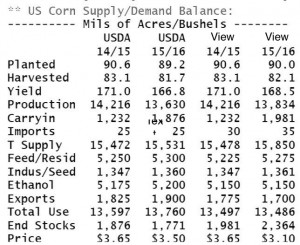

- The USDA raised both old and new crop US corn stocks. In old crop, this is a function of lower projected ethanol use, which in turn is a function of this year’s surge in ethanol yield (2.85 gal/bu, vs. 2.74 in 2014). New crop stocks were hiked amid larger carryin supplies. Season average price forecasts were left unchanged. Major balance sheet changes await the June Stocks report due at month end, but we still view the USDA’s total old and new crop consumption estimates as overstated. The pace of old crop export sales has been fading rather quickly in recent weeks, while a surge in S American production this year will limit export demand through the Aug-Jan period – and new crop exports are projected to be down noticeably from the current year. Remember that feed/residual is tracking well below the USDA’s forecast for two quarters, and a demand led bear market remains intact. 2015/16 end stocks of 2.364 billion suggest harvest prices of $2.90-3.10.

- The world balance sheet changes that provided the catalyst for weaker CBOT corn trade on Wednesday:

- The USDA increased Brazil’s harvest to 81 million mt, up 3 million mt from May following ongoing rains in early May – and better than expected yield reports. Similarly good weather sparked a 0.5 million mt hike in Argentina’s crop. And new crop Russian production and exports were raised 1 million mt amid a surge in seeding in Southern Russia. USDA boosted old and new crop world trade to account for record total supplies in major exporting countries, but it’s still giving the US too much market share. Gulf corn is not competitive beyond July – even into traditional destinations – and rather than build stocks to a record 20 million mt, we expect Brazil to be a dominant exporter in the Aug-January period. Total Black Sea supplies are projected down just 0.5 million mt from 2014/15. All of this leads to a highly competitive world corn trade in 2015, which is not bullish for futures prices or fob premiums. Adverse weather is required to lift Dec corn above $3.90 for any length of time. Also do not underestimate the impact of corn upon wheat markets!

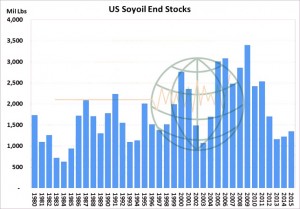

- The USDA made a few minor tweaks to the soybean balance sheet estimates, but the final message was left unchanged: old crop soybean supplies through to the end of the year will exceed that which is demanded, while stocks will further inflate next year! In the old crop balance sheet the USDA raised the crush forecast by 10 million bu to 1,815 million, noting better than expected domestic soymeal disappearance, while exports were also increased by 10 million bu to 1,810 million. Stocks were thus reduced by 20 million bu to 330 million bu and the season average price was lowered by a nickel to $10.05/bu. In the new crop, there were two minor adjustments. The first was the lower carry in, while crush was increased by 5 million bu to 1,830 million. End stocks were lowered by 25 million bu to 475 million and the season average price was unchanged at $9/bu. The report was anything but bullish, and we expect that NASS will find another 1 million acres in 2015 US soy seeding.

- In the soy product balance sheet, both meal and oil production increased due to the larger crush forecast, while old crop meal exports were lowered by 100,000 short tons to 12.7 million tons. The soybean oil yield was lowered fractionally while imports increased by 25 million lbs to 225 million. The USDA increased biodiesel use by 100 million lbs to 4,900 and food/feed/industrial use increased by 50 million lbs. Year end old crop stocks were lowered by 15 million lbs to 1,225 million and the season average price increased a penny to 33 cents/lb. In the new crop balance sheet the USDA raised biodiesel use by 100 million lbs to 5,100 million. Food/feed/industrial is expected to remain unchanged from 2014/15, though the FDA is expected to release it’s final decision on a trans-fat ban next week. This could have major impact on domestic food use going forward. The season average price forecast range increased by a penny to 30.5-33.5 cents, which should cap new crop soybean oil rallies at 35-36 cents. July soybean oil above $.34 looks fully priced.

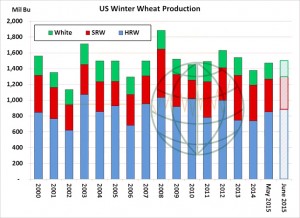

- NASS lifted US winter wheat production 33 million bu to 1,505 million, well above prior trade expectations. This is largely a function of a bigger projected harvest in KS, where recent rainfall has been helpful and will at least add to quantity. The KS crop was increased 43 million bu to 315 million. Other minor boosts are noted in MT, NE and CO, which offset reductions of; 3-11 million bu in OK, SD and TX. Total HRW production is pegged at 887 million, up 34 million from NASS’s estimate in May. SRW production is estimated at 414 million, down 2 million from previously. Winter white is estimated at 204 million, up 1 million. Of note, without improved exports – which are unlikely amid heavily overvalued fob premiums – HRW stocks in 15/16 will surge to 420-430 million bu, vs. 282 in 14/15 with stocks/use projected at a record 55%.

- The USDA in its all-wheat balance sheet raised old crop stocks 3 million bu amid slightly reduced exports. New crop stocks were lifted 15 million bu to 814 million. The USDA has acknowledged the potential for reduced quality across the S Plains, and so boosted feed use 15 million bu, which was not enough to offset higher production and carry-in supplies. We await the June stocks report for final end stocks confirmation, but we expect feed/residual use to be revealed some 70 million bu below the USDA’s estimate. New crop exports are overstated – perhaps significantly so – amid a slow pace of sales to date and no sign of competitive Gulf offers into September. Sub-$5.00 wheat will likely return in the weeks ahead, and the USDA’s world balance sheet adjustments confirmed that the US will be a very modest world player in 2015. US end stocks will approach 1.0 billion amid lacklustre exports and with favourable N Plains weather.

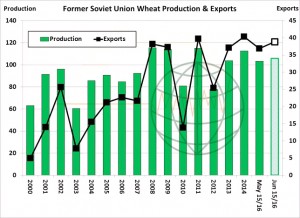

- World wheat production in 15/16 was raised 2.6 million mt to 721.5, while total consumption was raised 3 million mt. Total global wheat stocks are pegged at 202.4 million mt. This is down 900,000 from May but is 2 million mt above 14/15 and is the highest since 2001. The highlight of the world numbers is a 2.5 million mt increase in Black Sea production (1.5 million mt in Russia, 1 million mt in Ukraine), most of which was put into exports. Total FSU production is projected at 106 million mt, down 6 million mt from 2014. However, amid larger carry-in supplies, total FSU wheat supply is down just 3 million mt from last year. Exports are pegged down only 1.5 million mt. Such a Black Sea surplus implies that fob offers there will range from $180-195/mt into early autumn. This is equivalent to $4.40-4.70, basis spot CME. Major exporters will again have ample surpluses in 2015, which will work against sustained rallies in the US. A test of recent lows is expected during harvest.