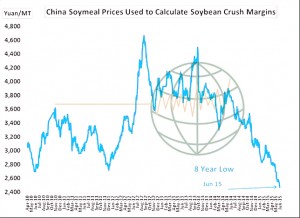

The Chinese soybean meal market has accelerated its decline and most market sources now argue that China will have to more aggressively export soybean meal to rid itself of excess supply. With record soybean imports arriving, this may take until the end of the summer. Chinese soybean meal prices now rest at an 8 year low and there is no bottom in sight with cash defaults accelerating. Falling soybean meal prices in China (and around the globe) are likely to pressure crush margins. This looks like the last supportive peg for $9.00 spot CBOT soybean futures.

NASS reported soybean planting progress on a national basis advanced to 87%, with 11 states more than 90% complete. National crop ratings were little changed, with good/excellent down 2% at 67%, while the index of all crop ratings was down slightly. As seen in the chart below, the index of all ratings continues to reflect a very high rated crop and we see no reason to disagree with the June WASDE yield of 46 bu/acre. With adequate old crop stocks and favourable new crop ratings, we hold to a view of selling rallies for a decline to $8.40-8.60 by mid to late July.

Corn crop conditions as of Sunday were pegged at 73% good/excellent, down 1% from the previous week. Declines of 2-8% are noted across the E Corn Belt due to wet weather. Note that IA’s crop improved 2% to 82% good/excellent. Modest boosts also occurred across the S and C Plains. Some yield projection models maintains a forecast of 166-169 bu/acre! The crop is 30-90% silking across TX & the Delta/Southeast. Steady/higher conditions are expected into late June as excessive precipitation ends beyond the next 3-4 days.

NASS’s weekly wheat crop update featured only minor changes to US wheat conditions. Winter wheat is rated at 43% good/excellent, unchanged from the prior week. The largest downgrades occurred across the S and E Midwest amid excessive rains. PNW ratings improved 2%. Spring wheat is rated at 70% good/excellent, up 1% point on the week amid small improvements in the Dakotas. US winter wheat is 11% harvested, vs. 15% last year, though this progress will accelerate into late June amid reduced precipitation and at least average temperatures.

Dryness concerns in Europe have eroded, and now include just portions of Germany and N Poland. Canada will see normal to above normal precipitation through the next two weeks. Moderate to heavy rains are scheduled across Eastern Australia in the next 48 hours, and so major world production threats are lacking.

Finally, recall that through the week ending June 11th, funds in the US liquidated a sizeable portion of their net short position. It is now back to monitoring the Black Sea’s surplus in determining ultimate seasonal lows in world cash market. A retest of $4.60-4.70 spot Chicago futures is expected in the next 2-3 weeks. Short covering rallies will be capped above $5.10 basis July Chicago.