- It has been another day of gains in Chicago as the trade debates what could wet weather mean for US seedings and yields in both corn and soybeans. Some ponding and low level flooding was noted last year in mid-June across Iowa and E Nebraska with this year’s flooding taking in N Illinois and parts of W Indiana. It will be the weather next week that will be key in terms of a needed warm/dry period. On the bright side, Midwest soil moisture levels are estimated to be the best since 2010 but there seems to be agreement that recent rains have taken the edge off yields in MO, IL and IN.

- Overnight saw China announcing that it is scrapping its programme to stockpile rapeseed/canola and will offer growers subsidies instead, starting with their imminent harvest. This seems to be a replication of what happened last year in soybeans and cotton in that the government no longer wants to offer high minimum prices and consequently build their own domestic stockpiles. The news is bearish for global rapeseed/canola and it begs the question, are the grains going to follow in terms of reduced minimum pricing.

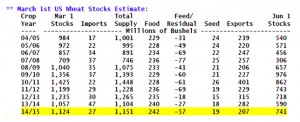

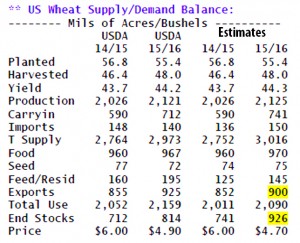

- A more in depth review of the US wheat stocks position follows:

- The highlighted 2014/15 line in the table above projects final 2014/15 US wheat ending stocks at 741 million bu. This is up 29 million bu from the USDA’s forecast in its June WASDE and down just marginally from prior estimates due to lower projected imports in the Mar-May quarter. Year-end stocks of 741 million bu are the largest since 2011, while annual stocks/use at 36.8% is the largest since 2009. Lofty stocks are well known, but the issue ahead is that stocks will continue to build. US wheat is in a demand-led bear market.

- We peg final 2014/15 exports at 852 million, down just slightly from the USDA’s 855. Final imports are estimated at 136 million bu, vs. the USDA’s projected 148 million. However, we expect feed use in the final quarter to be heavily negative, with the USDA’s annual feed/residual forecast some 35 million bu too high. There’s no shortage of wheat, and even early harvest reports across the far Southern Plains have been encouraging. Moving forward, we are in agreement with the USDA’s production estimate, though there’s room to grow the spring and durum harvests amid normal summer weather. However, it is demand that remains overstated – exports in particular! US exporters will struggle to reach even 900 million bu in 2015/16, and total consumption in the coming marketing year is expected to grow by just 4% – while the total US wheat supply will increase 9%.

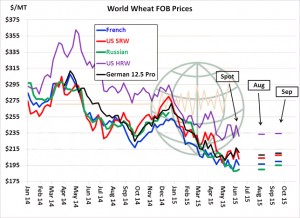

- The graphic below illustrates current world fob price relationships for delivery in the July-September period. Like the past12 months, US Gulf wheat is poorly positioned to sell anywhere outside of already captive markets (favoured nations in E Asia, Africa and the W Hemisphere). Gulf SRW is even priced near parity with much better quality German origin into August, and HRW is offered at a lofty premium of $34-46/mt ($.90-1.00/bu) to all other origins. A year ago, US wheat was far more competitive and without a crippling drought in Australia in September, US exports may even decline on the year (sub 850 million bu) taking 2015/16 US wheat stocks near 1,000 million bu. It is stocks/use, rather than simply stocks, that will cap rallies above $5.25 spot Chicago, into late 2015. Harvest lows could form near $4.40-4.60.

- Finally, the German Co-op association has downgraded their crop estimates on account of dryness as follows:

- The above data has brought some further focus to the trade, particularly to dryness is N France where conditions have arguably been dryer than in Germany, and shows little relief in the next 10-14 days. If the downgrade in the German crop was replicated across the whole EU we would be facing a 12 million mt crop reduction (vs. the USDA’s 6 million mt). Clearly the other side of the equation remains, where is the demand, and this is perfectly valid – but do not underestimate the farmers willingness to “shut up shop” in the face of a crop issue – if that is what we are about to see.