Weekly CCI Analysis:

The CCI/CRB index closed lower with crude oil pushing closer to $50/barrel amid the anxiety over China and Greece’s economic outlooks. Greece is seeking a package of $50 billion to stay in the €uro while China is struggling to maintain its pace of 7% GDP rate growth as it becomes more of a domestic led economy. Although China’s stock market was able to recovery 8-9% by the end of the week, the damage to consumer confidence was already accomplished with 1000’s of stock issues closed and a loss of $3 trillion noted. We have previously pointed out the serious issues that China has with excessive debt and a rapidly ageing population. Although China will be likely be able to orchestrate a stock market recovery, the outlook for China’s future economic expansion is dimming. This means that the bullish super cycle for world commodities will have to find another long-term demand driver into 2020.

Longer-term soybean analysis:

Soybean futures traded a broad range through the week and finished little changed. Selling and profit taking developed in the first half of the week, while fund buying and short covering returned into and after the July WASDE report. The report offered little insight, but expectedly confirmed a tighter old crop balance sheet. The USDA lowered old crop stocks to 255 million bu on increased crush, exports, and residual use. New crop US soybean production increased due to larger acreage and no change in yield, while stocks declined due to lower carry in. The big question for the market going forward is weather and yield. Warmer/sunny/drier weather conditions are needed in the E Midwest for crop condition ratings to improve. We believe in a minimum US 2015 soybean yield estimate of 45.5 bushels/acre – 0.5 bushels/acre under the NASS July forecast. Longer term, it’s the lack of US soybean export demand that will pressure prices as China is active in securing Latin American soybeans that could drop US soybean exports by 100-200 million bu and raise 15/16 US soybean stocks above 500 million bu.

Longer-term corn analysis:

Corn futures settled 6-7 cents higher and advanced to new rally highs. Greater than expected rain fell across portions of IL/IN this week, and the trade’s estimates on yield are wide ranging. Funds are placed firmly on the long side of the market. Whether these new bets are ill placed will hinge upon July/August weather – which we note is improving. The models in recent days have trended drier/warmer across the C and E Midwest. If this outlook is realised, we maintain that national yield will exist in a range of 164-168 bushels/acre, which in turn suggests an average fall price of $3.40-3.70, basis Dec. Even the USDA’s crop balance sheet in July suggests the market is overvalued by 30-40 cents. The focus of the market will shift to lacklustre export interest beyond the next 5 weeks. US exports are needed to sustain any lasting bull run, and this will be difficult amid steep discounts in South America. Brazil sold 2 cargoes of their corn into the US this week. A more dire weather pattern in July is needed to validate $4.50 Dec.

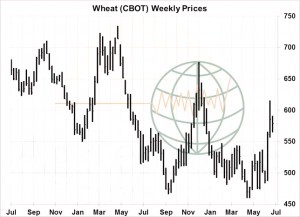

Longer-term wheat analysis:

The wheat market lost 14-20 cents as the interest of funds in new long positions waned. Black Sea cash prices are only inching higher, rather than following sharp gains in the US, and prices now are only discouraging demand growth. The USDA’s July WASDE added more fundamentally bearish input by raising Black Sea production (and exports), and projecting total world end stocks in 2015 at a record large 220 million mt. This is largely due to lower Chinese demand, but is also indicative of weak global consumption. Russian fob prices remain the world’s benchmark and offers for Aug/Sep rest at $200-205/mt, which is comparable to $4.90- 5.00 spot Chicago. EU wheat is offered at an equivalent to $5.15. We view Chicago wheat as overvalued by some 30-50 cents. Funds are expected to liquidate their newly established net long position as the US export opportunity languishes. A return to $5.00 is forecast.