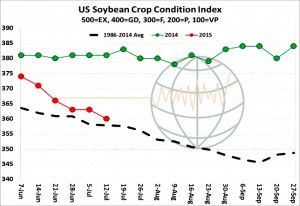

- NASS reported a further decline in soybean crop ratings, with national good/excellent slipping 1% to 62% as declines in the east continued to offset gains in the west. Excluding the 2012 drought, IN crop ratings are now the lowest since 1996 (for mid-July) while MN ratings are the 2nd best on record. It’s a case of the good and ugly for Midwest soybean conditions. 38% of the crop was blooming and 6% was setting pods, both of which are right near the 5 year average. The weather forecast at the start of the week calls for near to above average temps with near to below normal rain for the wettest parts of the Midwest. Our view is that the season’s low in crop condition ratings is at hand. US ratings will likely improve into August. We hold to a US soybean yield of 45.5 bushels/acre and that a seasonal high is being scored at the CBOT amid bearish seasonal trends.

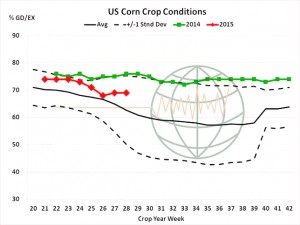

- US weekly corn crop conditions were steady at 69% good/excellent. Changes of note included good/excellent downgrades of 4-5% in IL, OH and PA which was offset by 1-2% improvements across MN, MO, NE and the Dakotas. The ratings point to WASDE being right on keeping yields at trend at 166.8 bushels/acre. In 1993, another wet year, US corn good/excellent ratings fell to just 49% good/excellent, 20% lower than the current crop. The 2015 US corn crop is 27% silking, vs. 31% a year ago and 34% on average. We view this evening’s crop update as bearish relative to $4.50 Dec, with the 2-week forecast projecting welcomed warm/drier weather across the E Corn Belt. And while the speculative market debates yield/production, prices are viewed as expensive against S American & Black Sea origin supplies as well as deferred ethanol margins. A US yield at or above 164 suggests a range of $3.60- 3.90. Current corn futures are very rich relative to known fundamentals.

- US spring wheat crop conditions improved 1% to 71% good/excellent amid uniform boosts across the Dakotas, MN and ID. This compares to 70% good/excellent a year ago and a 10-year average of 68%. The crop is 91% headed, vs. 66% a year ago. Winter wheat is 65% harvested. Our sources maintain a Russian harvest estimate of 57-59 million mt and so total Black Sea production may rise another 1-2 million mt in subsequent WASDE releases. We expect a test of $5.30, Chicago, once a top is posted in corn, and wheat is overvalued via any statistical measure above $5.50. The world market is facing record large stocks. There is no demand story in wheat and futures are overvalued relative to stock/use analysis.