- Today has seen a mostly weaker Chicago led by soybeans as light soybean/corn spreads were unwound on profit taking. Chinese stock market weakness added to the weaker tone. Also the fundamentally overpriced US soybean and meal markets when compared with S America appears to be being noticed right now. Technical support in Sep CBOT wheat has also given way leading to weakness.

- As the US$ rallied energies (crude oil, gasoline and ethanol) weakened pressuring ag markets. Weekly US ethanol production was 289 million gallons, 1 million lower than the previous week, and roughly in line with the pace needed to meet the USDA’s projected forecast.

- The US weather forecast, which is so influential right now, is little changed with helpful rain across the W and N Corn Belt with warm/dry conditions in the East. There is no excessive heat indicated outside the S and E Plains.

- Anticipated export sales are at levels unlikely to inspire confidence of a return to US competitiveness and as such new crop corn and soybean export commitments look as if they will remain well behind last year’s levels.

- US corn and soybean markets will require a steady flow of bullish news (where from we know not) in order to maintain the recent rally. Yield data will be unknown until August/September and coming weather looks favourable, and the US’s poor position as far as export competitiveness in global markets will likely cap rallies. In the absence of lasting heat/dryness in August, or a rapid shift to further flooding in the E Midwest, it certainly feels as we have made intermediate highs in the early part of this week.

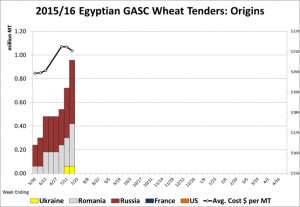

- Yesterday (in the absence of an update due to travel commitments) saw Egypt secure a further 235,000 mt of wheat, 120,000 mt from Romania and 115,000 mt from Russia pretty much as expected. The volume of offers from Russia and Romania reached over 800,000 mt, all offered cheaper C&F than the single French FOB cargo (most of the French were away celebrating Bastille Day). Of note is that the Russian/Romanian prices were some$15-30/mt below comparable US Gulf levels further highlighting the non-competitive position of the US right now.

- The Iran nuclear deal looks as if it will open the path to weaker crude oil/biofuel prices as well as the return of Iran to the wheat market (despite their $50/mt import duty which may be something of an obstacle). Something to watch in coming weeks and months.