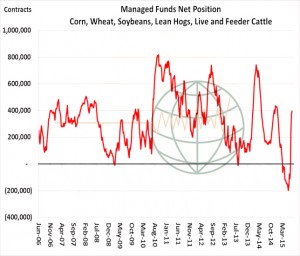

We talk frequently about the funds and their influence on markets and market pricing, probably more so in the last five or six weeks where we have seen some huge moves in positions and pricing where there has been a rush out of short positions and into new net long positions in the US Ag futures markets. The biggest change has been in corn, soybean and wheat positions in the past 3 weeks. And note in the chart below, the combined activities of funds has been much more volatile and in concert with each other since 2013. If combined net long ag positions exceeded a net 400,000 contracts, it would signify that traders start watching for a net short position in the grain and soy markets. It seems that funds are now either long or short – instead of being out on the sidelines!

International Agri Trading Ltd

Trading, Analysis, Consultancy