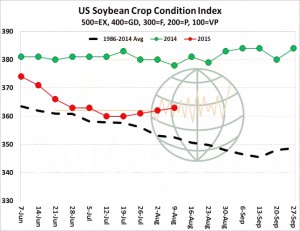

- National soybean ratings through last week held steady at 63% good/excellent although the index of all ratings advanced slightly as 1% moved from good into excellent. Crop ratings bottomed in early July and have since counter seasonally inched higher on reduced rainfall and sunshine. The mid-summer increase in ratings is improving the odds of trend or above national yield, while a few late summer soakers could push the US yield to 46 bushels/acre or above.

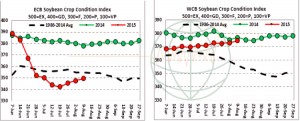

- However, despite the national figures it is interesting to break out crop ratings by the East and Western Cornbelt. Note from the graphic below that the WCB continues to creep higher and is nearly unchanged from a year ago, while ratings in the WCB continue to advance. From our view, yield potential is improving at the end of the summer.

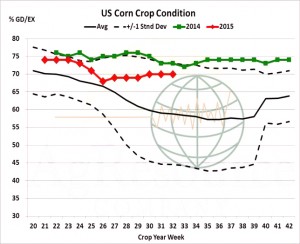

- US corn good/excellent ratings as of Sunday were unchanged at 70%, down just 3% from a year, and which some work indicates an August yield of 166 bushels/acre. By-state changes of note include improvement in MN (now at 89% good/excellent), SD and NE. Downgrades were recorded in NC, ND, PA and WI. All other major producing states were unchanged. Nationally, 50% of the crop is in the dough stage, vs. 49% on average. The market as a whole expects US yield to be 164.5 bushels/acre, and 2015/16 end stocks to be lowered 150 million bu to 1,450. But also on Wednesday, S American exports should be increased based on the pace of sales to date, which suggests US shipments will (should) be lowered.

- US spring wheat conditions as of Sunday were pegged at 69% good/excellent, vs. 70% a year ago. Spring harvest has reached 28% complete, vs. 20% on average. NASS’s August report is expected to reveal lower corn and soybean harvest estimates and end stocks. But US wheat production should be raised 10-20 million bu, and recall EU and Black Sea crops should be raised a combined 1-3 million mt. Major exporters supply and stocks/use will be higher on the month. Russian fob prices for delivery into November are priced at levels comparable to $4.70-4.80, basis Chicago futures. Winter wheat is 97% harvested, up from 93% week on week, up from 94% year on year and ahead of the 5 year average of 90%.

- Today’s markets have lived up to expectation by displaying a classic “Turnaround Tuesday” with soybeans almost 30 cents lower, with corn and wheat shedding 3% in nearby positions. Wheat in both Paris and London and Rapeseed in Paris have (generally speaking) finished the day at levels below Friday’s closing prices displaying a serious disregard for the turmoil in Chicago yesterday.

- Is the Chinese currency devaluation, with potentially more to come, a factor? Our belief is that it is, as it will likely weigh on US$ denominated commodities and fears of further devaluation are not boosting confidence today. Crude oil is $1.80/barrel lower and gasoline and ethanol futures are trading $0.01-0.02/gallon lower. Last night’s crop ratings (see above) must also have come as a disappointment to the bulls.

- Tomorrow will be key but as a general comment the market is clearly poised to move – which way though? In soybeans one private forecaster has suggested as much as 2 million acres could have been lost to weather, which is supportive if true. If dry topsoils hit the E Cornbelt in coming weeks this too is supportive as yields could well fall and tighten the supply outlook, which is also supportive. On the other hand, US new crop exports are well behind last season at this time and S America is certainly pressuring US sales and looks likely to do so for some while to come, including the early US new crop period, and this will pressure prices.Technical momentum was seen as potentially (short-term) supportive yesterday, but today’s close could well reduce that support somewhat.

- In corn, EU November ’15 corn futures translate to $5.24/bu, up from $4.80 on 3 August. It is highly possible that tomorrow will see the USDA adjust the EU crop downwards by as much as 5-6 million mt and the Ukraine crop by 2-3 million mt (due to late season conditions). This is, unsurprisingly, supportive. On the other hand, US pollination weather and lack of heat in the forecast looks as if it could provide big yield potential in the N and W growing region, which would help to offset the heavy July rains in the East, particularly if weather conditions return closer to normal.

- US wheat stocks are seen higher by the trade tomorrow, and there is an expectation of an upward revision in both Russian and EU output.This, if delivered, will limit upside price moves.

- Clearly, tomorrow’s report is an important one!