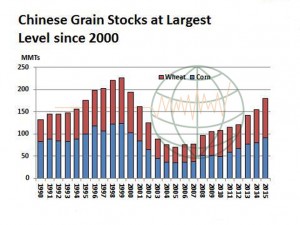

- China is swimming in grain! The chart below reflects Chinese grain stocks since 1990 – and today’s estimated levels are at their largest levels since 2000. Most Chinese grain users suggest that these grain stocks are being undercounted by USDA. China has guaranteed its farmers $9.70/bu corn in recent years which has spurred production and imports of other non GMO grain. The sheer supply of Chinese corn/wheat stocks has the Government planning for a policy change that could slow/end grain imports of nearly 20 million mt annually. Chinese ag policy needs to be closely watched as another record harvest approaches.

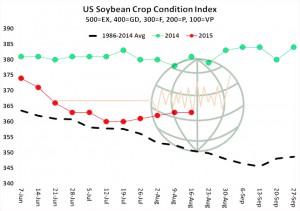

- After the close, NASS reported that national soybean crop ratings were unchanged through the week with good/excellent holding at 63%. Crop ratings declined in 7 states, increased in 9, and were unchanged in 2 states. The absence of a decrease in ratings is adding confidence to USDA estimates. We hold to a bearish outlook with resistance in November ’15 futures expected above $9.30, while our initial downside target rests at $8.50-8.60 by harvest.

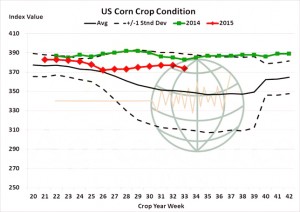

- Corn crop conditions fell 1 point to 69% good/excellent vs. 74% a year ago, following last week’s warmth and near complete dryness. Conditions also tend to seasonally erode beginning in late July/early August. However, steady to higher ratings are expected next week amid this week’s cool frontal pass, with the latest models still offering widespread totals of .50-3.00” to all but the far E Corn Belt into Friday/Saturday. As for acreage, assuming some 1-2 million acres are added to the FSA data series – which has been the case in recent years – we can find no reason that NASS will adjust their estimate until the final report in January. The goal of the market is now to find higher domestic and export consumption rates, which suggests a slow but steady bearish trend into harvest. We continue to remain willing sellers of 15-20 cent rallies.

- Spring wheat conditions are 70% good/excellent, above estimates of 69%, up from 69% week on week and up from 68% year on year, and the crop is now 53% harvested vs. 15% a year ago, and the winter wheat harvest is complete. Combines are actively rolling across the Northern Hemisphere and consumptive interest remains lacking. We would anticipate another Egyptian tender early this week on any additional price break. The Australian weather forecast maintains widespread shower activity across New South Wales on the weekend, with totals pegged as high as .75- 1.00”. El Niño continues to strengthen, and will likely continue to do so into the autumn months, but this so far has had little effect on the Aussie climate. US wheat futures are left following world cash prices, and to some extent US corn futures. There’s simply no shortage of food or feedgrain, and without a shift to lasting heat and dryness in Australia in late August and September, a range of $4.80-5.20 will be sustained through the months ahead.

- With less than an hour to go in Chicago soybeans and wheat are trading lower with corn just in positive territory. Widespread rains in the last 24 hours and a favourable forecast into next week appears to be showing the greatest benefit to the bean crop, hence price downside. The overnight drop in the Chinese stock market (some 6%) may also be contributing to weakness in the soybean complex. Many will question the correlation between Chinese equities and Chicago soybeans, and the link is somewhat convoluted, however the market is clearly uncomfortable with economic contraction in the world’s largest end user of soybeans and products – simple as that!