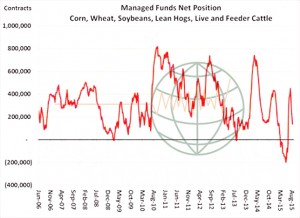

- Despite the recent liquidation, funds are still holding a net long position in US ag futures markets which is illustrated in the chart below. This is one reason why ag commodities are so closely following the developments in US and world equity markets as they (funds) push to shed any market exposure until the emerging market meltdown bottoms. It is our expectation that some sort of trading bottom should be formed in ag markets by mid-week. However, there will likely be a retest of that bottom by late September. Our view remains that commodities will not forge their final bottom until the 4th quarter 2015.

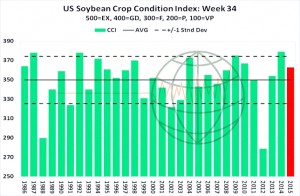

- Soybean futures fell to sharp losses at the start of the week on liquidation triggered by steep losses in global equity markets. Funds were estimated as net sellers through the day of 15,000 contracts in soybeans, 6,000 contracts in soybean oil, and buyers of 3,000 contracts in the soymeal market. The USDA’s daily export reporting system showed soybean sales of 120,000 mt made to an unknown destination, but total new crop sales remain well behind last year. S American basis has turned higher in recent weeks, but it will be quite difficult for the US to catch up on lost business. Crop ratings were unchanged for the 4th consecutive week with good/excellent holding at 63%. The chart below shows the 2015 crop as being rated well above average for late August. Harvest progress was reported at 15% in LA, just ahead of the 5 year average of 11%. Soybean futures this week are now deeply oversold and traded to our initial downside target, though our view of the market remains bearish. Large global supplies and the lack of demand growth look to cap rallies in the year ahead and the market looks to be targeting the 2008 low, under $8.

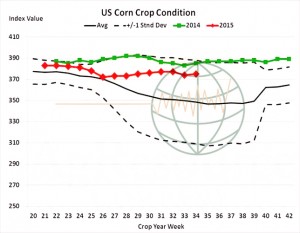

- Corn rallied 4-5 cents amid corn-bean spreading and a sharply lower US$. Crop conditions this week were unchanged at 69% good/excellent, with a 1 point improvement noted in the crop condition index amid a shuffling of the good and excellent categories (good was down 1; excellent was up 1; the excellent category has more weight in the index value). A more neutral pattern is likely into NASS’s September crop report, and as China’s absence from the US market has more of an impact on soybeans than grain markets. However, focus has to remain on demand, with Argentina still the world’s low cost supplier and with Brazilian export commitments having surged 2 million mt in just the last week. Crop condition models maintains a range of 166-170 bushels/acre relative to national yield in the September report, and China now requires importers to report who the final end user of bought supplies will be, which is just another hurdle to large scale foreign imports. Harvest progress is 87% complete in LA, 47% complete in TX and 31% in AR. We continue to favour a policy of selling into short covering rallies.

- Wheat futures ended 3-6 cents higher, as a plunging US$ offset steep losses in energy and equity markets. There’s little new fundamental news to report, with Black Sea cash prices a bit weaker and with rainfall to linger across Eastern Australia over the next 2-3 days. But contrary to corn and soybeans, funds as of last week were short and a modest short covering effort was noted yesterday. Russian wheat is buyable for spot delivery at $181/mt, which is comparable to $4.50 basis September Chicago. French wheat for Sep/Oct is quoted at $190-195, with US Gulf SRW at $204 and HRW at $218. The Russian ruble today hit a new all-time low, which has pushed domestic prices in US$ terms down to $3.25-4.00. Russian wheat priced in rubles has been rallying, but not to the degree that export controls are needed. Currencies will keep non-US wheat competitively priced into early winter. US weekly export shipments through last Thursday totaled 10.2 million bu, roughly half of the previous week’s total and well below the average pace needed to hit the USDA’s forecast. We calculate that some 16-17 million bu per week are needed, so far, this level has been achieved just three times. More weekly sales and shipment data is needed, but the USDA’s forecast appears overstated without a Northern Hemisphere crop threat this autumn/winter – and note that widespread rainfall is offered to Europe and Central Russia in the first week of September. Short covering rallies will likely be a periodic feature of the market. We continue to believe that fundamental advances will struggle above $5.30, basis December futures, and rallies above this are opportunities!