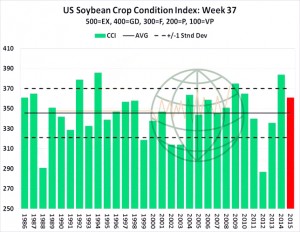

- US soybean crop ratings, issued last night, inched lower with good/excellent down 2% at 61%. As noted in the chart, the overall condition of the crop remains well above average. 35% of the crop was reported as dropping leaves versus the 5 year average of 31%. Harvest in the far south is running slightly ahead of average, and starting to move into the S Midwest. NASS will begin reporting national US soybean harvest progress next week. The FSA Crop Participation report on Wednesday could offer a bullish surprise and set the next soybean selling opportunity. We would see any rally in November soybeans to $9-9.25 as a potential sale at this time, and we see the market caught in a $8.50-9.25 range.

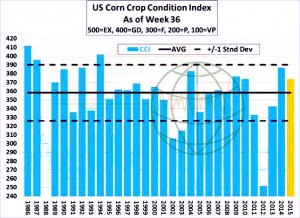

- Good/excellent US corn condition ratings were unchanged this week at 68%. Ratings boosts in IN, IA, PA and WI offset losses in KS, MO, NE and NC – conditions have countered the seasonal downward trend once again this year. The crop is 35% mature, vs. 25% a year ago, and is 5% harvested, vs. 4% a year ago. Progress will accelerate in the weeks ahead amid a lack of widespread rain and abnormally warm temps. Early yield results have been highly variable, but it’s far too early to establish a US trend, and key will be actual data from the Western Corn Belt, which is expected in the next two weeks.

- US winter wheat planting progress as of Sunday reached 9% complete, on par with the five-year average but below last year’s 11%. Spring wheat is 97% harvested, above last year’s 72% and above the five year average of 86%.

- Chicago has seen the grains, corn and wheat, ease a touch and soybeans holding onto recent gains in advance of what many expect to be bullish FSA crop participation estimates tomorrow. There may be a further push higher in soybean and product prices on release of figures, but if the data does not justify a decline of a million acres or more , we would expect a widespread decline in prices. There is a widening gap between world grain and soybean fob prices and US levels, which the US can ill afford as their export volumes are already struggling compared with previous years

- Perhaps more specifically, Black Sea fob wheat, corn and feed wheat prices are steady to weaker from last week, totally ignoring the recent Chicago price rally, yet still struggling to find demand despite the lower prices. French export silos are reported to be full and global grain markets continue to fail to uncover fresh demand. It is reported that SE Asian consumers have cover well into early 2016. The current lack of Black Sea price uplift in corn and wheat could well suggest that the rally in Chicago may be short lived. As always, time will tell.