- The significance of US crop ratings is dwindling as crops mature and harvest advances, but national soybean good/excellent ratings gained 2 points to 63%. NASS reported national harvest progress at 7% complete for the week, versus 3% last year and the 5 year average of 7%.

- Corn yield reports remain variable, but there’s still no compelling evidence to suggest a national yield below 165 bushels/acre by the final count. Good/excellent ratings as of Sunday were pegged at 68%, unchanged for an 4th consecutive week. The crop condition yield model is also unchanged, and maintains a national final yield of 167-170. Harvest reached 10% complete, vs. 7% a year ago and 15% on average. Amid ongoing warmth and dryness, we fully expect the crop to be 35-40% gathered by the first week of October, just above the 5-year average.

- US winter wheat planting is 19% complete, which is 10% above a week ago but down from 23% last year and a touch behind the five year average of 20%.

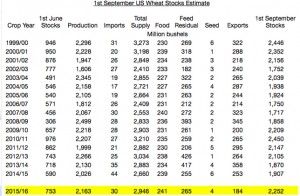

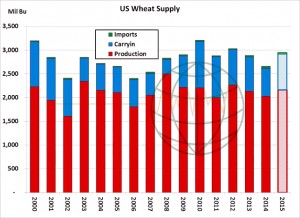

- NASS will release its 1st September stocks report on the 30th, as well as its small grain summary, in which final wheat production is revealed. Our final 2015/16 US wheat production estimate stands at 2,163 million bu, up 27 million from NASS’s last estimate amid slightly higher spring and durum yields. Despite reduced imports from Canada, total US wheat supplies as of the end of the first quarter of the crop year are tallied at 2,946 million bu, up 286 million from a year ago and the highest since 2012. However, wheat futures are at multi-year lows due to slow demand rather than supplies. Notice in the table that Jun-Aug US exports at 184 million bu are the lowest since quarterly supply and demand record keeping started, while domestic use is up just 2%. The USDA is also likely overstating projected feed use.

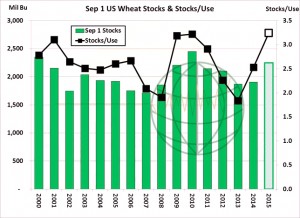

- US wheat stocks as of 1st September are pegged at 2,252 million bu, up 345 million (18%) from a year ago. Total consumption through the quarter is estimated at 694 million bu, down 59 million (8%) from last year. Recall the USDA projects total wheat use in 15/16 to be up 6% from the previous year! The graphic below, which includes 1st September stocks as a percent of June-Aug consumption, best illustrates the issue plaguing US wheat prices. Stocks are certainly higher than recent years, but 1st September stock/use at 3.24 rests at a 29-year high. Amid current world price relationships, which have changed very little in months, it will be difficult for the US to work through its building wheat stocks. Higher domestic use won’t be enough; exports of 1.0 plus billion bu in the next several years are needed.

- Two words can describe Chicago markets today, dull and down! The Brazilian Real continues to fall reaching decades long lows vs. US$ and both crude and US equities are sliding on fears of rising interest rates despite poor global economic prospects. The decline in the Brazilian economy and rumours that a number of President Dilma’s key appointees are on the brink of resignation do little to add confidence. On the plus side, soybeans priced in Reals are at record high levels, and even though input prices (seed, fuel and fertiliser) will be more costly, the economics of agricultural production continue to look positive. Expansion in planted acreage looks even more likely, and substantial, and the global oversupply of grains and oilseeds seems irrelevant from the Brazilian grower’s perspective right now.

- US and global grain export demand shows little signs of life in the face of the rapidly expanding US harvest and there is evidence that cash basis levels are coming under pressure. Monday’s gains are looking as if they will be short lived, and the prospect of a big volume Chinese soybean frame contract deal looks to be the only market supportive news right now.

- Black Sea and EU sellers levels are pretty much unchanged amid limited demand. We understand that ant fresh tender of size would be aggressively pursued as export silos are full and sales need to be concluded in the near future in order to keep stocks moving.

- Dull markets with limited physical trade suggest that we have not yet seen the lows!