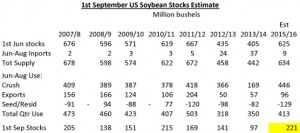

- The USDA’s ending stocks estimates for the 2014/15 crop year have been in a wide range over the last year. The peak stocks estimate in September 2014 was 475 million bu, with estimates steadily grinding lower to the most recent USDA forecast of 210 million bu. Crush and export totals have steadily moved up as world demand for US soybeans and meal exceeded initial USDA estimates, while annual residual rates have also increased following each quarterly stocks report. We estimate a 4th quarter residual of minus 129 million bu, with 1st September stocks at 221 million bu. The steady increase in annual residual suggests that NASS could cut the 2014 crop size (acres and yield).

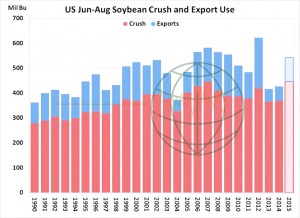

- US soybean crush and export use can be estimated fairly accurately based on weekly/monthly trade reports from the USDA – and the monthly crush data from NOPA. Combined June-August crush/export usage is estimated at 542 million bu. Total US quarterly exports are estimated at 96 million bu, a 67% increase from a year ago, but still an exceptionally low quarterly export rate as S America supplied the majority of June-August world soybean trade. US crushing margins remained exceptionally strong throughout the quarter due to another year of relatively high soybean meal prices that supported a record large June-August crush rate. Total soybean crush through the summer is estimated at 446 million bu, an historic 21% increase over last year, driven by a significant increase in domestic meal demand.

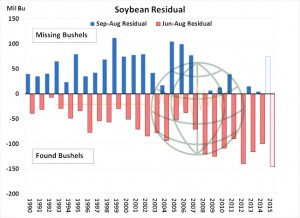

- With supply, crush, and exports generally known, the final piece of the quarterly stocks calculation left to understand is the residual. We estimate an annual residual at 70 million bu, and based on the previous three quarters implies a 4th quarter residual of minus 145 million bu. If realised this would be a 45% increase in the number of “found” bushels over last year. The chart plots annual and 4th quarter residual, and note that over time, the number of found bushels in the 4th quarter has steadily increased. The trade expects that the large implied 4th quarter residual is an indication that NASS could lower the estimate for 2014 soybean production. But with large production expected, and carry in supplies to more than double, the reduced crop size will be viewed as insignificant to prices.

- After yesterday’s dull and uninspiring session in Chicago we have seen active fund buying in wheat and soybean oil today. Dec ’15 wheat has moved above its 50 day moving average ($5.07/bu) and this has triggered further buying, which has also spilled over into European markets in London and Paris. The mid-September high of $5.03¼ also triggered buying and short covering when it was reached and breached. This, in addition to dryness in Russia and Australia, could well see us move into a market uptrend rather than the longer established downtrend we have been experiencing.

- In a surprising move a vessel has been nominated to ship Brazilian corn into SE US. The surprise is that we are on the cusp of the US harvest “gut slot” and importing foreign corn in advance of the second or third largest crop on record feels strange to say the least! Argentine corn is offered at $160/mt and US Gulf is $175/mt, which equates to around $0.38/bu more. Ukraine has fallen to $159-$160/mt, cheaper even than Argentine supplies and $0.41/bu below US Gulf. Global cash prices are not following the Chicago move higher – yet, and this argues that Dec ’15 Chicago futures should struggle above $3.85/bu. If US Gulf is to compete globally, which means $165/mt or $4.20/bu, the equivalent Chicago Dec ’15 level needs to be $3.50/bu assuming global prices remain unchanged ($0.33 lower than today’s close).

- The Brazilian Real has fallen further to 4.11 vs. US$. The lower levels are attributed to an impasse of the Congress to control their dramatically rising budget deficit. Impeachment of President Dilma is much more widely discussed, and no one truly knows quite how low the currency can go. Talk of Russian wheat sales into Brazil have been heard although many (including ourselves) question whether this is in fact the case. With the Argentine election imminent there is a strong suggestion that a reduction in export taxes could be on the cards as well as a sharp fall in the “blue” Peso. Brazilian buyers would doubtless benefit from waiting until the Argentine situation is clearer.

- An interesting day when compared with yesterday!