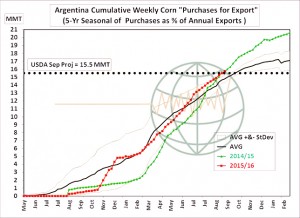

- The correlation between soybean exports sales in early autumn and final shipments has been well documented. And though a similarly strong correlation is not available between corn sales and final exports, we are becoming increasingly concerned with the pace of exports – especially in the face of hefty discounts noted in S America and the Black Sea into December. It is possible to track S American export commitments weekly, and importantly, there has been no indication that sales from S America are slowing. The pace of Argentine corn purchases for exports has already met the USDA’s 2014/15 forecast. These purchases and final exports do not always match, but we expect Argentine exports to be revised 1 million mt higher by the final count. As of Monday evening, Argentine origin corn is the world’s cheapest.

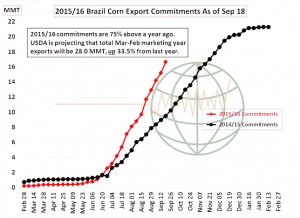

- Brazilian corn export commitments are similarly outpacing the USDA’s forecast, which is very likely a function of the safrinha crop still being understated. Corn export commitments to date stand at 16.7 million mt, up an incredible 75% from a year ago – and notice the shape of the line in the attached graphic. Logistical capacity in Brazil has been expanded, and there’s no reason Brazil won’t continue to sell and ship corn into late winter, at which point the soybean loading program begins. Brazilian corn exports, too, are likely understated by at least 1 million mt, if not more. Recall the USDA projects final Brazilian corn exports will be up only 35% from the prior year. Brazilian corn is offered at $.38- .42 over December futures, a $.20-.30/bu discount to US Gulf corn.

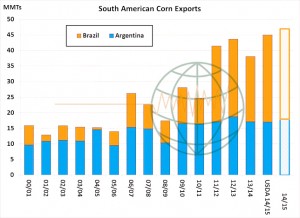

- Our belief is that without a substantial hike in total world corn trade, the US must give S America more market share and take away market share from the US. We project total S American corn exports to reach a record 47 million mt in 2014/15, while US corn exports are likely 2-3 million mt too high. Again, US export sales of Sep/Oct correlate poorly with final exports, but price relationships do have an effect on monthly demand and the US is simply not competitive in the near term – and Gulf basis shows no signs of eroding. We should keep the lofty pace of S American exports – and weak pace of US exports – in mind amid upcoming changes to US production. A downward to revision in US export demand (which we believe is coming) will largely offset any 1-2 bushels/acre decline in yield.

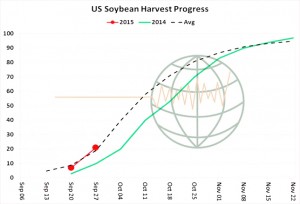

- NASS reported soybean crop conditions fractionally lower through the week, with harvest progress through Sunday advancing 14 points, to 21% complete. The main feature for the market this week will be Wednesday’s stocks report.

- Corn crop conditions were unchanged at 68% good/excellent, and ratings should remain unchanged through the rest of the season. Harvest progress reached 18% complete, vs. 11% a year ago. The lack of a bigger advance is mostly a function of producers shifting to soybean harvesting, and we expect progress to meet the 10-year average (33%) by next weekend. It’s very possible that production is lowered modestly in October (yield results remain variable), but in the context of overstated export demand, a yield of 165 plus bushels/acre is more than adequate. We maintain that corn is fairly valued in a range of $3.40-4.00, basis spot, without dramatically adverse world weather.

- US winter wheat planting progress has reached 31% complete, vs. 35% on average. 7% of the crop is emerged. Rain is needed in S Russia, but it’s tough to argue for prices above $5.20, basis spot Chicago, with French/Black Sea wheat trading at levels equivalent to $4.35-4.45.

- Tuesday trade was mixed with positioning ahead of Wednesday’s report evident. Trade estimates are suggesting near to unchanged corn ending stocks and a modest drop in soybean end stock. Wheat remains stuck somewhere in the middle with any rally attempt stifled by a lack of US and global export demand, whilst Russia remains in a dry weather trend across the southern winter wheat belt in the coming ten days.

- We would expect to see volatile initial reaction to Wednesday’s report but in the end it will be exports, yield data and global weather forecasts that will dictate price trend