- Looking at global wheat trade, US export sales have failed to improve in recent weeks, and total commitments as of mid-Sep stand at 405 million bu – a six year low and 15% below a year ago. Recall the USDA project final annual wheat shipments to rise 5% on the year, and to meet the USDA’s forecast an average weekly sales pace of 15 million bu is needed from now till May (vs. sales of 10-14 million in recent weeks). Poor US wheat export demand has been well documented, but looking at global data, the whole world seems to lack a wheat demand driver. Amid already lagging interest in forward coverage, it will be difficult for the US to boost its share of world trade amid completely uncompetitive Gulf offers. This is not news, but just how long this uncompetitive position lasts is uncertain – possibly into 2016 without adverse N Hemisphere weather.

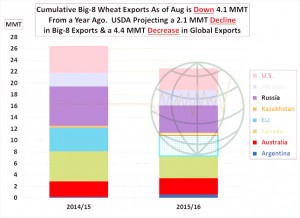

- 2015/16 EU wheat export licenses, which correlate well with actual exports, are down 23% from a year ago. Like in the US, this does not at all align with the USDA’s forecast, which calls for an annual decline in shipments of just 8%. We also calculate Jul-Sep Black Sea (Ukraine, Russia and Kazakhstan) shipments at 13 million mt, down 11% from a year ago. The graphic below summarises world trade from major exporting countries through the first quarter of the international trade year. Total trade is down 4.1 million mt from the previous year, which matches the USDA’s forecast but also illustrates that lack of a global demand driver following better than expected harvests in North Africa and the Middle East.

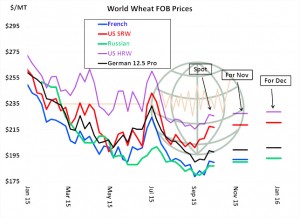

- Benchmark prices in Russia and Europe have rallied noticeably in the last week, but still exist well below recent years. Russian wheat is offered at $187-193/mt for delivery into December, vs. $230/mt in late September last year. EU origin is buyable at similar levels for Oct-Dec arrival, vs. EU offers a year ago of $225. Also, Gulf wheat premiums to other origins have not changed, and despite the advance in Black Sea prices, US wheat remains some $25-27/mt above all other origins. A seasonal bottom has likely been scored in world wheat cash prices, but we fully expect exporters to jump at the chance to fill Egypt’s or any other major importer’s needs. Grain markets remain oversupplied, and we should be cautious on short term rallies.

- Today the EU commission has estimated 2015EU soft wheat output at 144.6 million mt, up from 140.7 million mt a month ago whilst corn is forecast at 58.4 million mt, a reduction from 58.7 million mt last month. Rapeseed output is seen at 21.1 million mt and increase from last month’s estimate of 20.8 million mt.

- The Russian government has agreed to the change in wheat export tariff as we outlined a few days ago and the effective date is 1st October.

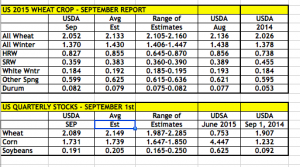

- NASS’s stocks and small grains report is viewed as mixed when viewed alongside trade estimates:

- There is little to change the longer term picture and market reaction saw soybeans push to month highs testing $9 resistance pre report but have eased back subsequently. Corn turned negative although wheat was buoyed by the decline in crop size.

- In summary, the report did not offer any major surprises for corn and soybeans, and did confirm another year of building corn, soybean, and wheat stocks. To date yield results from the field are confirming the USDA’s September estimates and our view is that harvest lows have not been reached.