- Last night’s update on US harvest progress showed soybeans to be 87% and corn 75% harvested, which compares with five year average figures of 80% and 68% respectively. The update also reported winter wheat rated as good/excellent to be 47% compared with 59% a year ago.

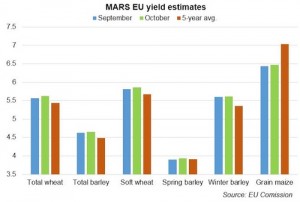

- The EU’s MARS unit updated EU crop yield estimates for 2015, and wheat, barley and corn were all increased compared to the September figures. Soft wheat was estimated at 5.86 mt/ha (Sep 5.81 mt/ha and 2014 at 6.14 mt/ha), total barley at 4.65 mt/ha (Sep 4.63 mt/ha and 2014 at 4.90 mt/ha) and grain maize at 6.47 mt/ha (Sep 6.43 mt/ha and 2014 at 8.16 mt/ha). As far as 2016 is concerned, the report suggests that poor weather in some eastern and northern areas of the EU may adversely impact winter plantings, which could in turn reduce yield. However, as we are constantly stating, it is still extremely early to draw a conclusion from such data at this stage of crop establishment and development.

- In Chicago today the grains (corn and wheat) both closed lower whilst soybeans closed higher and it was reported that funds were once again active in buying.

- There is an expectation that Thursday’s US export sales data will show soybean volumes to be in excess of 2 million mt as Chinese buyers remain active in the face of ongoing positive crush margins although it appears that the pace is easing a touch compared with last week. It should be noted that China still has December and January import requirements left to cover.

- In Russia the Ruble is down by 3% today, and 6% in the past week (on the back of lower crude oil prices), leaving exporters having an easier time sourcing grains from the interior. However, it has been noted that some growers are reluctant to perform against existing sales without further incentive or bonus payment leaving yet another hiccup in the export supply route. Thankfully this is not a feature of our domestic market place, long may that continue!