- The graphic below displays rallies in US corn price from the September low to the Sep-Nov high. Our work suggests it would be perfectly reasonable to expect a rally but the extent will be a function of the stock/use ratio. The higher the ratio, the weaker the season’s rally. In the light of the October USDA figure we would expect a recovery in front month corn of some 8-10% from the September price low ($3.61), which points to a test of $3.95-4.00 basis December or March Chicago futures. Any lasting rally will require lasting and widespread damaging weather.

- Brazilian trade data for the month of October was reported on Monday, showing soybean exports at a 12 year high for the month, at 2.1 million mt. The official government data was just short of the 2.5 million mt total that had been implied by private shipping data. In Feb-Jan marketing year that is used by the USDA, exports are record large at 51.6 million mt. The USDA increased their export estimate by 2.65 million mt to 52.9 million. To reach the USDA target, exports need only average 400,000 mt/month. However, vessels are surprisingly still being added to the Brazilian lineup, and total export commitments are now estimated at 54.6 million mt. Increasingly, it look as though both the USDA and CONAB have understated last year’s crop size and both are underestimating current year exports.

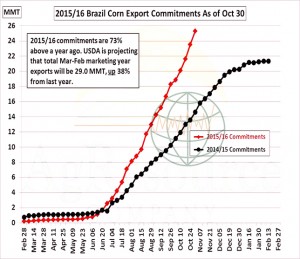

- Official Brazilian corn exports in October totaled a record 5.5 million mt, up 2.0 million from September and up 2.4 million from October of last year. After a slow start to the marketing year, exports have surged, and we expect this torrid pace of shipments to continue well into early 2016. Crop year to date corn exports from Brazil rest at 13.5 million mt, up 30% from last year, and this year on year difference will continue to widen in the months ahead. Brazilian fob offers are $7-9/mt ($.17-.23/bu) cheaper than US offers into January, and there’s been talk of new crop corn offered for delivery beyond next August. The Brazilian Real, which has strengthened in recent weeks, is still historically weak and this is helping exports. There’s been no sign that Brazilian corn sales are slowing.

- However, the official shipment pace only begins to tell the story. It is possible to track total Brazilian export commitments through official exports as well as vessel lineup data, and total commitments are substantially above year ago levels and are well ahead of the pace needed to meet the USDA’s forecast. Brazilian corn export commitments as of October 30th totaled 25 million mt, up 73% from last year and already 87% of the USDA’s forecast, which we believe is too low. Record shipments are expected in Nov and Dec, and only the beginning of Brazil’s soybean loading program in February will slow corn shipments. Brazilian production, along with their willingness to sell into the world market cannot be understated. Upward revisions to Brazilian exports will be countered with a reduction in US exports. We estimate final Brazilian corn exports at 32-33 million mt, vs. the USDA’s 29, and still ending stocks will be historically large at 15-16 million mt.

- An interesting development in Egypt in the form of an international poultry tender has been announced today. The details are to be released tomorrow, but it is for whole poultry and poultry parts, doubtless more will be revealed in the full detail.

- Reuters have reported that spot trading on Argentina’s main grains and oilseed market has slowed sharply as farmers hold on to their crops in the expectation that this month’s presidential run-off vote will lead to a reduction in hefty export taxes. It is well known that Argentine farmers have long hoarded their crops as a hedge against the country’s high inflation rate. Argentina’s tax agency said this week farmers were holding back an estimated 19.7 million mt of soybeans – equivalent to one third of Argentina’s annual soybean crop – as well as 21.4 million mt of corn and 9.5 million mt of wheat.

- Today has seen “technical considerations” drive Chicago wheat to new weekly highs and this has spilled over into corn and soybean markets. December wheat in Chicago rallied through its 100 day moving average amid lacking fundamental news, in actual fact global cash markets have been displaying a weaker tone.

- Weather models are offering helpful and widespread rainfall acrossRussia’s winter wheat belt next week. Some 0.5-0.75” is forecast, and this represents 70-100% of normal for early November. So far C and E Europe have seen normal to above normal rain since the beginning of October. Australia’s forecast is drier in Victoria and New South Wales in the coming ten days easing fears of losses. The point being made here is that with unchanged global cash prices, wheat fundamentals have not changed and huge surpluses remain.