- Chicago markets have given back a little of yesterday’s trashing today in profit taking but we reiterate that it will take adverse S American weather to sustain a price rally. Fresh news is lacking and both the bulls and the bears are looking for fresh input to maintain their desired direction!

- Crude oil has extended yesterday’s losses with spot futures dropping another $1.30 around midday.

- The Ruble has dropped a 2% (quietly) this week and is testing last week’s lows once again.Black Sea weather conditions are appearing to improve with above normal precipitation projected across the whole of Ukraine and Russia’s winter wheat belt into the end of November.

- The Brazilian trucker’s strike is waning as government fines levied on truckers blocking highways bites into the action. There appears to be limited disruption at this time and crop/fertiliser movements are not affected.

- Polls indicate that Mauricio Macri is leading the polls in Argentina, and if elected a devaluation of the Peso will likely free up additional soybean exports and expand corn and soybean acreage in 2016. Our view is that the results of Argentina’s election is somewhat important to longer term price direction.

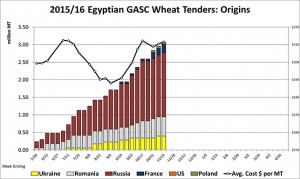

- Egypt’s GASC tendered for wheat for a second time in as many days and picked up 120,000 mt split equally between Russia and France at a price of $211.63/mt basis C&F, just over $1.00/mt above yesterday’s traded level.