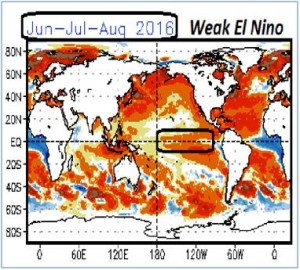

- From a longer term weather perspective the latest NOAA (National Oceanic and Atmospheric Administration) ENSO (El Niño Southern Oscillation) forecast calls for El Niño lingering across the Equatorial Pacific this summer. This is much different from the dire La Niña warnings of October and November. El Niño continued to strengthen amid world oceans that are their warmest on record. It is expected that the world weather forecasting community will lower their expectations of a dire Midwest drought in coming months as La Niña now looks to be put off until Q4.

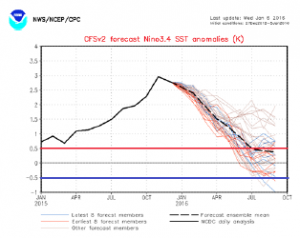

- Longer term, the climate forecasting community has become less aggressive on El Niño’s decline through the next six months. El Niño has doubtless peaked, but the odds of La Niña being established by summer are falling rapidly. The graphic below display a host of model projections into October, and notice the median projection features a weak but lingering El Niño into autumn. As such, it’s premature to discuss a hot/dry US growing season in 2016.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 76,500 mt, which is below estimates of 200,000-400,000 mt.

Corn: 252,900 mt, which is below estimates of 400,000-600,000 mt.

Soybeans: 638,800 mt, which is within estimates of 400,000-700,000 mt.

Soybean Meal: 46,500 mt, which is below estimates of 50,000-150,000 mt.

Soybean Oil: 3,500 mt, which is within estimates of zero-20,000 mt.

- Brussels has issued weekly wheat export certificates totalling 397,143 mt, which brings the season total to 13,979,514 mt. This is 1.474 million mt (9.54%) behind last year.

- Chicago markets have found some stability ahead of the usually exciting January report scheduled for release next Tuesday and limited market movement is anticipated between now and report day. Barring surprise corn or soybean residual use figures we would expect focus to return swiftly to slow US exports and generally favourable global weather conditions.