- Macro markets have kicked off February with a whimper, mostly due to ongoing negative indicators from China. The graphic below charts monthly PMI, and notice that this indicator has been at levels that show economic contraction (50) since summer. A string of six consecutive months of contraction in the manufacturing sector is not helpful to the macroeconomic climate, and we expect global investors to remain wary of risk until emerging markets show signs of strength.

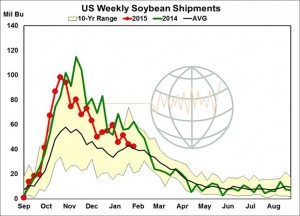

- Weekly soybean export inspections were within expectations, but also the lowest since early October, at 42.4 million bu. The cumulative annual total slipped further behind last year, down 172 million bu or 13% vs. the USDA’s annual forecast that calls for just an 8% decline in US soybean exports. NASS reported a total December soybean crush of 167 million bu, in line with expectations and 9 million bu over December’s NOPA total. Both meal and oil yields were below the NOPA total. S American weather forecasts lean bearish for Chicago trade, while discounted prices on soybeans and meal look to slow US export programs.

- Egypt’s GASC today announced a new wheat tender for early March shipment only to later announce its cancellation due to lack of offers. Whether the lack of offers is in any way connected to three cargo rejections for ergot contamination (according to Reuters) is clearly a matter for speculation, but the timing of both events looks highly correlated! Rejection for trace contamination, within the 0.05% tender specification, seems highly suspicious and if we were the exporter/shipper we would be speaking with legal counsel about initiating arbitration proceedings. Seemingly there is a difference of opinion between Egypt’s supply ministry, which includes GASC, who maintain they will allow shipments within specification whereas the quarantine authorities have refused to accept even trace contamination. Left hand – right hand???? The additional risk is too much for exporters to take on board, particularly when prices are extremely competitive right now and the required risk premium too high.

- We now face an interesting conundrum with Egypt not in a position to lose global connections and ties whilst exporters still have issues reducing their record surplus stocks.

- Outside markets continue weak with crude oil weak at midday, down $1.30/barrel and gasoline also down, the DOW was lower, down 285 points at midday and European wheat markets also displaying weakness. Fund short covering has been ongoing in the last couple of weeks or so, yet remain net short in the three major ag commodities (estimated soybeans short 80,000, corn 125,000 and wheat 100,000). The slow and steady short covering exodus has not produced a volatile spike, which would have likely ensued if the exit had been been less orderly.