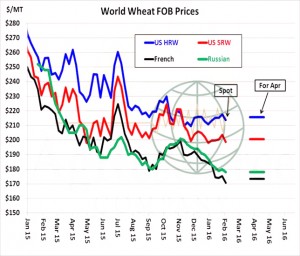

- World wheat cash offers best illustrate the demand issues facing global grain markets. Just yesterday French offers for March posted new seasonal lows, as Egypt rejected a cargo over the weekend due to phytosanitary issues that we reported yesterday, and as we calculate record (or close to record) surpluses across the Black Sea and Europe. US wheat, meanwhile, has been flat. Wheat markets elsewhere are probing for a level that boosts major importer consumption, but they do not seem to have found it yet, and financing on behalf of major importers has become a real issue.

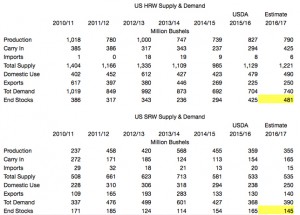

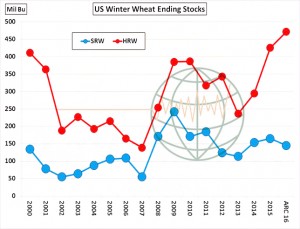

- In its January seedings report, NASS cut 2016 Hard Red Wheat planted area by 2.4 million acres from the previous year, and cut Soft Red plantings by 370,000 acres. The tables below assume average abandonment and trend yields, and notice that if realised, production is only modestly changed from 2015/16, and total supplies will be steady to higher amid enlarged carryover stocks Total US wheat consumption is projected slightly larger in 2016/17 amid a boost in world trade, weather across wheat areas of N Africa, the Middle East and Brazil has been less than perfect – but Hard Red stocks will remain burdensomely large. Soft Red stocks are projected to contract 20 million bu, but will be very close to the five year average. Soft Red premiums to Hard Red will expand over time. The point of is that even a sharp decline in US acres does not change in the structure of the US wheat market (a demand-driven bear market). Adverse weather is needed to prevent another build in all-wheat stocks.

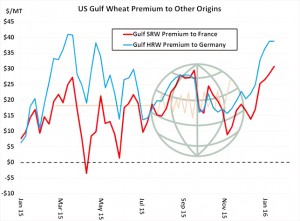

- Funds continue to slowly pare back their large net short position, but world the cash market remains decidedly weak. As reported, Egypt found no offers at its latest tender, with major exporters citing Egyptian credit difficulties and stringent phytosanitary specifications. Egypt faces a real problem, both political and economic, if it cannot source wheat in a timely matter. However, major exporters also have a problem with massive remaining surpluses and Egyptian demand is needed. French cash prices fell $1/mt to just over $169 (a new seasonal low, and a level comparable to $3.95, basis spot Chicago), and the graphic below displays the US’s premium to competing markets. The current $30-40/mt premium has been rare over the last 12 months, and this disconnect between the US and world markets is unlikely to last. The global market has the potential to bottom out closer to $160/mt this spring, and it’s important to keep this in mind. Note, too, that ENSO forecasts continue to trend towards El Niño lingering throughout 2016, which will be a boon for S Plains soil moisture.