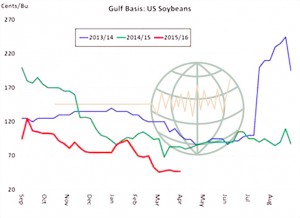

- US Gulf soybean basis has fallen to four year lows with spot Gulf bids at $.40/bu. This low basis speaks volumes on the availability of old crop US supplies. 2015/16 US soybean end stocks are likely to end up being the largest in a decade at 450-530 million bu. The last time that US soybean end stocks exceeded 225 million bu was 2006, which was the pre-ethanol era. For a decade, US soybean end stocks have never been larger which highlights the supply pressures building in the cash soybean market. We do not expect much change in basis into summer.

- The US$ scored a secondary top in February against the Brazilian Real, just under 4.1 Reals/Dollar and has since declined to 3.6-3.7 over the last several weeks. US$ weakness against the Real has lifted Brazilian soybean offers to near even with the US, while Argentina has the cheapest soybeans for sale. While Brazilian soybean prices have rallied, the chart below illustrates that Brazil continues to undercut both the US and Argentina in the soybean meal market. Brazilian meal today is offered at $44/mt under the US and Argentine meal can be had $15/mt cheaper. While the underlying market fundamentals offer no good reason for markets to move higher, the momentum right now is up and funds continue to buy ahead of the USDA report. We continue (rightly or wrongly) to hold to a view that Chicago soybean (and product) markets are forging a seasonal top.

- Wednesday started firmer at the US$ eased lower on what were perceived as dovish comments by US Fed Chairman Janet Yellen, a rate hike in April looks less and less likely. However, Chicago markets have eased and are in negative territory as we approach the close. It should not be forgotten that N Hemisphere weather is becoming a greater influence and more important, and this has not been missed by latter trade particularly in Chicago wheat markets. Soaking rains across the drier areas of the Plains in the latter part of the next two weeks appear to be growing in forecast confidence at this critical crop development time.

- It seems that the recent rally in US soybean (and product) markets has been about fund flows, palm oil and the weaker US$, this situation has seen the funds pushed out of a record net short into a small net long position in the face of bearish fundamentals. Our thoughts are that April, with planting in the US, will see a return to a more fundamental approach to prices and direction.

- Argentine harvest data is impressive in both corn and soybeans with crop estimates rising. The majority of private forecasters are putting Argy soybean output in the 60.5-62 million mt range with feed corn at 27-27.5 million mt. Bear in mind if this year’s yield equals last year we will see output at 64 million mt.

- We have been witnessing pre-report position liquidation which has taken its toll on wheat prices with corn following. Clearly anticipation of the data release tomorrow and its likely impact on markets is getting to traders!