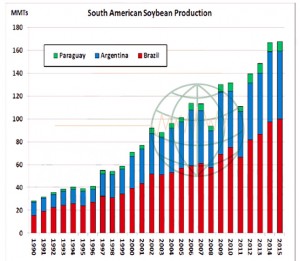

- Yesterday we reported that the world is awash in grain – and that new crop US/world corn and wheat supplies appear to be near or record large in the new crop year. The grains lack a supply driver to sustain a rally with China looking to dramatically slow its future feedgrain imports. That is known! What is unknown is S American soybean production and China’s future soybean demand. It is historically unusual that S American soybean production is not better known with the Brazilian harvest largely completed and Argentina active in their harvest. Brazilian soybean yields dipped in the last 15% of the NE Brazilian soybean crop while 13% of the Argentine crop was deluged with over 300% of normal rainfall during the first three weeks of April. The combination of each is leaving the world less certain of 2016 S American production! We estimate the 2016 Brazilian soybean crop at 98-99 million mt, down 1-2 million from WASDE. Moreover, the 2016 Argentine crop was cut to 56-58 million mt from their estimate of 59 million in April. This too would be down 1-3 million mt with crop quality being questioned by world soybean importers.

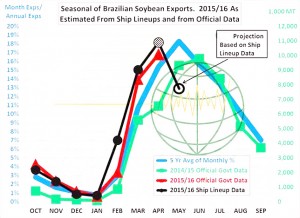

- The final size of S American soybean crops are being questioned at a time that China appears to be ramping up demand/imports. Notice in the chart below that Brazil shipped out a record 10 million mt plus of soybeans during April – a record. No one expected that Brazilian ship loading and logistics could work so smoothly! The Chinese are amazed how Brazil executed its soybean purchase program flawlessly. Notice that from January, Brazil was able to ramp up its new crop soybean export program. This will not be lost by world soybean buyers in their purchase plans for 2017. Based on vessel lineups on May 3rd, a sharp downturn is expected in Brazilian soybean loadings during May. By all statistical evidence, it appears that the peak in the Brazilian soybean export program was pulled forward by 30 days as Chinese demand wanes. One should not extrapolate April’s Brazilian shipping program to bet that China will take 86-87 million mt in the 2015/16 crop year. Research argues that the loadout and purchase pace will slow rather abuptly into August with Brazil exporting soybeans into October.

- The chart below reflects that China is likely to take 84 million mt of soybeans in 2015/16 and 86 million in 2016/17. The future growth in Chinese soybean imports will likely be curtailed by reserve sales and a less fragmented livestock herd. China’s soybean meal use/head is near that of nearby neighbors S Korea and Taiwan – which is why WASDE forecasts less forward growth in their baseline report. The three unknowns in the soybean complex are: 1) 2016 S American final crop sizes and the quality of 8 million mt of Argentine beans, 2) Chinese demand growth, with their crush margins at the lowest levels in years; and 3) Will Argentina plant more grains and less soybeans during the 2016/17 growing cycle due to existing tax policy? Argentina ended its export tax on grains, but is reducing their soybean export tax by 5% per year, which likely will produce a crop of 55-57 million mt in 2017 as farmers seed more corn & produce a record 38-40 million mt corn crop. The marketplace is trying to prod world farmers to seed more oilseeds and less grain via crop ratios. Neither US nor world soybean stocks are tight, but the unknowns have to be clarified before soybean prices can relent. However, the knowns of big and bigger grain crops will act as a drag on soybean valuations. July Chicago soybeans above $10.50 are not fundamentally justified.

- Intl F C Stone forecasts the Brazilian safrinha (winter) corn crop at 49.8 million mt, down from 56.6 million mt a month ago due to dryness,which implies a total crop of 77-78 million mt – the lower end of expectations – and the soybean crop at 96.5 million mt a million below last month.

- Chicago soybeans (and meal particularly) have today found support following yesterday’s declines and end users appear to have been active in the wake of yesterday’s cheaper prices.

- It seems the soybean meal market is unwilling or unready to quit the bullish side just yet and consumers appear willing to top up on price breaks. Once cover is taken it would seem logical to anticipate lower prices.