- Funds might well be back (as of last Tuesday – latest data) holding their largest net long positions in corn, soybeans and wheat since the middle of 2014, which given good weather so far in the N Hemisphere suggests that they remain in the situation of almost demanding an adverse weather issue if the Chicago rally is to remain in situ.

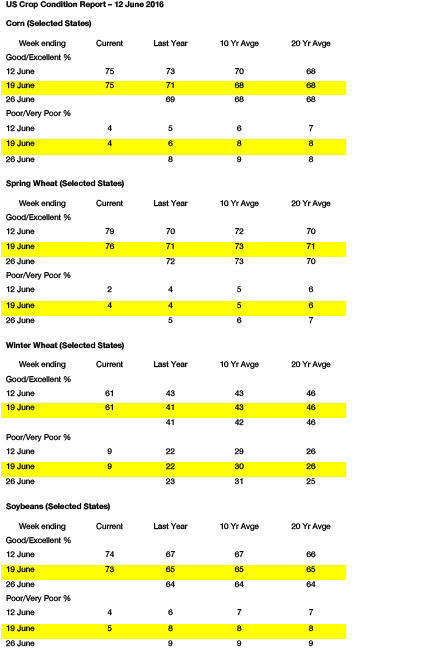

- Soybean futures started the week lower on a wetter weather forecast, which ultimately left them, and products (meal and oil) lower at the close. Rain chances across the corn belt (oddly named as it includes huge swathes of soybeans as well) were predicted this coming week, especially in the drier parts of the east where last week saw a fall in crop ratings. Overall, it has to be remembered that the US soybean crop condition is well above average and one of the best rated in recent history! Does it justify current pricing? A price break lower feels unlikely until such time as we know more about summer weather patterns.

- Corn markets were easier as weather premium eroded on improved weather forecasts and their widespread rainfall prospects. It is important that the rain falls, not just for the crop but also for prices, as soil moisture levels in the eastern midwest are in sharp decline. Crop condition remains good, and it should be noted that we are 4% above last year (good/excellent), and just 1% shy of this week in 2014 when record yields were set! As with soybeans does this justify current pricing? Again, as with soybeans, we need to see what the remainder of the summer weather pattern brings!

- Wheat in Chicago also fell in line with corn as well as the proximity of the N Hemisphere harvest. Unlike corn, US wheat has to build a demand story, and the most likely route seems to be via livestock feeding rather than already price pressured exports. In Russia it seems interior cash prices are at a peak with harvest just around the corner and private forecasters edging their output estimates still higher. Some are talking of 65-66 million mt, which would simply add to global end stocks and from this perspective it does not feel that we have yet seen the market bottom.

- The fears of a British vote to exit the EU appear to be on the wane and £Stg rallied strongly as a consequence. The impact for London wheat vs. its MATIF counterpart was evident. Doubtless the market will retain some concerns until the result is announced in the early hours of Friday morning, UK time.