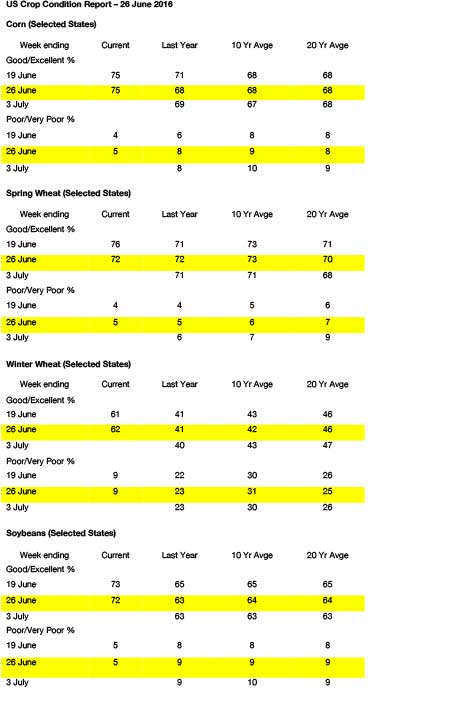

- Soybeans traded higher overnight, and extended gains through the day on technical buying and new export demand the product markets also both saw good gains. Ahead of the morning open, the USDA’s daily export reporting system showed sales announcements of 132,000 mt of old crop soybeans and 18,000 mt of new crop that were sold to an unknown destination. The sales announcement lifted soybeans at the morning open, and kept prices up through the day. The Crop Progress Report (above) showed an expected, but modest decline in national crop ratings. 72% of the US crop was rated as good/excellent vs. 73% last week. IN and OH crops improved on better rains, while conditions in IA and IL turned down as crops in the Southern and Western parts of each state need rain. Despite the decline, the overall condition of the US crop is still one of the best on record. Ahead of Thursday’s reports, we expect profit taking on further strength, with the market to then trade off the report numbers. Like last year, the acreage figure will likely be more important than stocks.

- Support was noted early, but the GFS, EU and Canadian weather models added rainfall to the Midwest next week and beyond. Wheat’s discount to corn also continues to narrow, cutting off potential export demand, and crop conditions remain rather lofty. As of Sunday, 75% of the crop was rated as good/excellent, unchanged on the week and compared to 68% a year ago. Rating declines are noted in IL, MO, ND and TN; improvement is noted in IN, MN and OH, and all states report good/excellent above 63%. It’s tough to find a major argument against the USDA’s national yield (168 bushels/acre), and some yield models indicates a potential range of 168-172. July weather is key, but we’ve highlighted that overall US pattern is not indicative of drought expanding in the next two weeks. In fact, abnormal dryness should ease across MO and Delta/Southeast this week. The crop is 6% silking nationally, including 14% in ND. Cash wheat prices across the W Plains are now quoted up to $.30/bu below corn. Black Sea feed wheat is offered today at $164/mt, down $10 from last week and compared to US Gulf corn $185. The wheat market’s need to clear burdensome supplies will weigh on US and global corn demand in 2016/17. At this time we do not expect to see weather driven rallies sustained.

- The lingering effect of Brexit continues to impact world currencies, and as such EU, Black Sea and US markets begin the week lower, and despite higher projected consumption, Black Sea feed wheat has fallen $10/mt from a week ago, and increasingly it appears the wheat needs to find a level that clears the market of excess supply. US spring wheat good/excellent ratings fell to 72%, vs. 76% last week and unchanged on last year. Winter wheat conditions were boosted 1% to 62%. Harvest progress through Sunday reached 45% complete, vs. 41% last year. The market, KC especially, has reached its initial downside target, though US wheat still isn’t cheap in the world market. EU/Black Sea markets have turned lower ahead of harvest, and in our opinion, additional price downside remains. Quality will be debated throughout harvest, but overwhelming quantities will weigh on grain markets until the next weather threat emerges. Note the normal precipitation is offered to Volga & Siberian Russia (spring wheat) through mid-July. La Niña will be established in some capacity by late summer, which will keep Australian crops well watered. Short covering rallies initiated by fund buying appear unsustainable at this time, and we do not see a longer term bottom until late Jul/Aug.