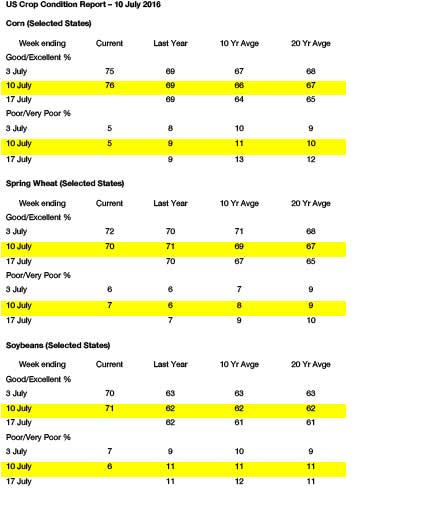

- Soybean futures tested immediate resistance at $10.70-10.80 Monday night and found selling ahead of the July WASDE report. At the close, November beans were a couple cents lower. The Crop Progress report showed a slight improvement in national crop ratings. 71% of the US soybean crop was rated as good or excellent versus 70% last week and 63% a year ago. The 2016 crop remains the 5th best rated crop on record. Crop ratings were lower in 5 states, higher in 11 states, and unchanged in 2. The best rated crop is still in WI and the lowest rated crop is in AR. Soybean exports last week were at a 13 week high, and we expect that weather worries and a strong late summer export program will continue to offer support on deep breaks. November futures should at least test $11.30-11.40 in coming weeks.

- Better than expected rains (2-4”) fell across the far N Corn Belt over the weekend, and widespread moisture worth .50-2.00” is forecast through early next week. The extended outlook still includes exceptional heat and a shift to drier weather beginning next Wed/Thurs, and we maintain a neutral outlook below $3.50. Crop conditions were boosted slightly, withgood/excellent pegged at 76%, vs. 75% last week, 69% a year ago and the highest since 1994. Notable hikes in ratings occurred in IL, MI, MN and MO. Current conditions are impressive. Another week of favourable pollination weather lies ahead, but the highest temps in years are forecast late next week and beyond. The major forecasting models end the day in mostly good agreement. The GFS is by far the warmest, but the EU and Canadian solutions also feature highs in the low/mid-90s across much of the Plains and Midwest, which places more importance on crop-finishing moisture in early August. We also mention that Gulf corn has fallen to a $10-20/mt discount to Gulf wheat, ethanol production margins are in excess of $.60/gallon through late autumn. Heat and dryness is offered to Ukraine through late July, and confirmation of a US national yield above 168 is needed to push Dec below $3.40.

- Today’s USDA reports are expected to show higher total US wheat production (and stocks) and a slight boost in global ending stocks. Until the size of the global wheat crop is fully documented, rallies will struggle. We note that Russian domestic prices continue to drift lower as harvest expands. Our sources indicate that harvest in S Russia has reached 50% complete, and yields remain better than expected. Quality is still an issue, but this will be an issue for protein premiums rather than futures price. Wheat still lacks a fundamental price driver, although corn’s reaction to next week’s hotter/drier pattern will be monitored. US spring wheat ratings fell another 2%, with good/excellent as of Sunday pegged at 70%, right at average and compared to 71% a year ago. Further deterioration was recorded in SD, where good/excellent is only 50%. Note that weekend rainfall (2-3”) across the Dakotas will help stabilise conditions. It’s still just a bit premature to call for a bottom in US/global cash markets, though seasonal lows are likely to be scored a bit earlier than normal this year. We look for a weak trend to persist in EU/Black Sea offers into late month.