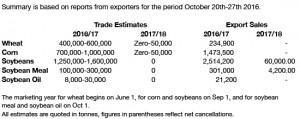

- US weekly export data released today is as follows:

- Brussels has issued weekly wheat export certificates totalling 452,003 mt, which brings the season total to 8.99 million mt. This is 1.03 million mt (12.97%) ahead of last year. Barley exports for the week reached 40,175 mt, which brings the season total to 1.33 million mt, which is 2.96 million mt (69.1)% behind last year.

- Strong weekly US export sales saw Chicago markets rally early on but fund selling (re)emerged in wheat as fund managers still appear to be in liquidation mode taking risk off the table ahead of next week’s USDA crop report. December ’16 Chicago wheat futures dropped below the 20 day moving average whilst corn prices continued to soften. A comment echoed by a number of fund managers, who are holding their smallest positions in many years, suggests that there are too many unknowns to hold large positions. Once the US election results are known and the USDA report is published this may well change.

- US soybean export sales were the largest of the marketing year to date with China reported to have taken 19.4 million mt, and the “unknown” destinations accounting for 9.8 million. More than half of the “unknown” volume will likely end up in China, which means that China has now secured some 900 million bu of US origin soybeans. Estimates suggest that they will take at least 32 million mt (1,175 million bu) of US soybeans in the season.

- Black Sea wheat prices are steady to firm with farmer selling lacklustre, the outlook for Black Sea wheat remains seasonally up into the winter and snow cover across Russia is dramatically expanding southward. Some traders doubt that Egypt’s floating of their currency will have any substantial impact on their future wheat demand. The public buyer, GASC, will likely have to take up a greater portion of demand from the private sector and we would anticipate a new wheat tender next week.

- The market is continuing to liquidate and we see support at $9.80 (Dec ’16 soybeans), $3.42 (Dec ’16 corn) and $4.08 (Dec ’16 wheat). We still see Chicago markets as rangebound with limited downside and we would be reluctant to sell breaks or buy rallies. The “big crop” “big demand” marketplace is still in evidence and when one trader wants to “zig” there will be others wanting to “zag”. Beware!