- Thursday was a dull day in the Chicago soybean markets with an inside day and lower close on profit taking. Old crop soybean meal took the complex lower and it seems funds were net sellers on the day. It is noteworthy that EU imports of soybean meal are running behind last year with last week at 385,992 mt and the cumulative figure from October standing at 5.4 million mt, which is only 91% of last year’s figure.

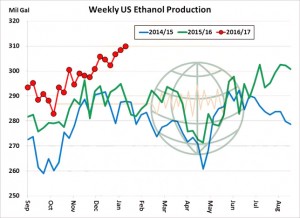

- Corn markets eased higher for another post-harvest high as weekly ethanol production hit another record, and was much larger than expected. Additional momentum would appear to be necessary to ensure the uptick remains in place, and a close above $3.68 could well trigger buy stops and fund short covering and/or additional buying. Argentine corn planting has reached 95% complete, a pretty normal figure for this time in the year, and BAGE estimates only 290,000 ha (6% of the total area) to be significantly impacted ny flooding, which is less that was feared by many.

- US wheat prices fell somewhat in an effort to maintain world trade share; Russian cash prices are unchanged through to April and it is important to point out that there is little bullish input in this market at present. Climatic estimates contain no real threats anywhere in the main wheat growing areas of the world through to early springtime. With potentially increased Black Sea acreages it will require adverse weather somewhere to draw down global stockpiles.

- As mentioned above, weekly ethanol production in the US continues to impress with another record set in the week to last Friday. This implies the USDA’s estimate is too low at this time but the graphic below shows seasonal production drops sharply from mid-winter into mid-spring. Doubtless there is a correction in the offing and reduced production margins will likely pressure grind rates in the next few months.