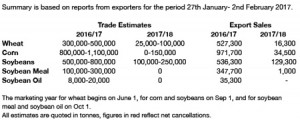

US weekly export data has been released as follows:

Brussels has issued weekly wheat export certificates totalling 482,594 mt, which brings the season total to 16.49 million mt. This is 1.15 million mt (6.54%) behind last year. Barley exports for the week reached 41,997 mt, which brings the season total to 2.76 million mt.

Today’s USDA report lived up to its “lacklustre” pre-release billing! Their US wheat export estimate has been increased to 1,025 million bu, which is a 50 million bu hike and dropped 2016.17 stock levels to 1,139 million bu. Corn ethanol production was increased by 25 million bu to 5,305 million bu, which reduced 2016/17 end stocks to 2,320 million bu. Soybean end stocks for 2016.17 were held at 420 million bu.

In world production the big surprise was 2016/17 Indian wheat output, which was reduced 3 million mt to 87 million mt. Brazilian and Argentine corn crops were left unchanged at 86.5 and 36.5 million mt respectively. Finally, the Brazilian soybean crop was left unchanged at 104 million mt whilst Argentina’s crop was cut 1.5 million mt to 55.5 million, which left global end stocks of 1.9 million mt at 80.4 million.

The market has initially viewed the reports as marginally positive for wheat, corn and soybeans, and whilst it is now done, dusted and history it seems that neither the bulls or the bears are going to rush into fresh new net positions on the back of the contents. However, it seems the Brazilian farmer remains reluctant to sell his new crop harvest due to currency, and this could force the Chinese buyers into staying with the US as supplier (for now) and potentially firm Chicago futures. Fresh highs in Chicago corn and soybeans could entice S American farmers into sales, but we will have to wait and see if this becomes the case.