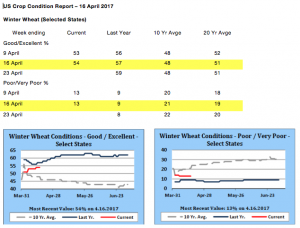

- US winter wheat condition data has been released as follows:

- We start the return to work which is within estimates with Chicago markets mostly lower as some private forecasters call a drier Central US weather profile, which resulted in some turning more to the sell side particularly in corn and soybeans. Wheat in Minneapolis is catching a bid on potentially tight US stocks as well as delayed plantings in Canada. The cooler and wetter forecast in Canada has many talking of reduced acres, which is underpinning wheat prices. Canadian farmers are worried about cold temperatures, snow and saturated soils as key planting dates near. Much of the Prairies are still dealing with snow and low lying water, that will take at least 2-3 weeks of warm/dry weather before seeding can really get going. This means that Canadian crops are likely to be seeded late, which will allow for more fallow acres amid poor prices. World wheat traders are starting to more closely monitor Canadian weather to gauge if and when planting might commence. However, the mentality of the market remains generally bearish in the face of large US and world stocks. These large stock levels can not be dismissed out of hand, but with so many certain of prices falling further it is now a time to exercise caution, particularly as we enter a new growing season. Our view is that we are in a broad trading range and the choppy nature of prices will continue until such time as we see some fresh news input.

- The IMF sees the global economy accelerating its growth to 3.5% this year due to a resilient China, rising commodity prices and sturdy financial markets. Combined, these features offer a bright outlook for expansion of the world’s GDP rate that should help elevate commodity demand. A 3.5% expansion of world GDP should bode well for the general outlook of the CRB Index for at least another few quarters. Goldman Sachs confirmed that it is exiting its long held US$ long position amid uncertain US Trump Administration policies and improved demand from emerging nations. A weaker US$ would help US export demand while damping the growth of grain and oilseed production in other countries.