- Weekly US export data has been released as follows:

- Weekly EU wheat exports reached 730,094 mt, which brings the season total to 22.19 million mt. This is 4.45 million mt (16.7%) behind last year. Barley exports for the week reached 147,532 mt, which brings the season total to 4.37 million mt.

- Ag markets in Chicago are a shade higher today with KC wheat leading the way as uncertainty over recent and potential freeze damage to the crop. The Trump administration’s change of heart over ongoing NAFTA membership and terms has also lent additional market support, albeit limited from a financial perspective. Crude oil has extended overnight losses and the market appears to be looking to test $48/barrel.

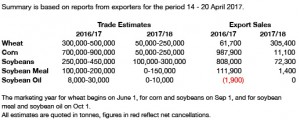

- US export data (above) showed better than expected soybean sales, corn sales were within expectation whilst the wheat figures were terrible, at least for old crop, and were at the lowest level in the 2016/17 crop year. Seemingly there were significant wheat cancellations, which clearly impacted the weekly total figure.

- On a more positive note, the US drought monitor has this week restricted actual drought to the southeast and eastern OK, and this is forecast to be eliminated within the coming week whilst any lingering abnormal dryness is disappearing across the W Plains. Currently some 22% of the continental US is experiencing drought vs. 36% last month and 40% this week last year. The latest weather discussions are focussing on planting dates, which have raised concerns, against the likelihood of a summer drought as soil moisture levels have received this recent upgrade.

- Away from the US, Morocco has increased its tariff on imported soft wheat to 135% for the remainder of the year as a consequence of their own improved harvest. This maybe provides a glimpse of what may be in the offing as far as overall N African production is concerned, which (if correct) somewhat reverses initial, and highly variable, output estimates.