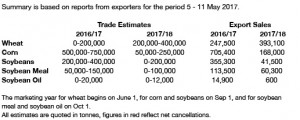

- US export data has been released as follows:

- Stratégie Grains have cut their EU grain harvest estimate by 3.6 million mt to 301.6 million mt, which should also be noted as an increase of 4.5 million mt year on year, but still behind the 2015 crop of 309.8 million mt. Dry conditions have impacted Spain in particular as well as France, UK and Belgium where output is expected to be reduced somewhat. Stratégie Grains’ downgrade reflected a 1.1 million mt cut to 142.7 million mt for soft wheat, and they left the door open for further revision depending upon weather conditions going forward. Barley output was reduced by 1.7 million mt to 59.6 million mt, a multi-year low.

- Chicago markets have seen soybeans trade sharply lower today, which has pulled the grains lower July ’17 soybean futures have tested, but not broken, key support at $9.40-$9.45. Soybean activity levels have been high, reportedly on the back of a corruption charge that is evolving against Brazilian President Temer, which it is suggested may well lead to his downfall in coming weeks. The news has left the Brazilian currency around 8% lower today, back at levels last seen in December 2016, around 3.38 vs. US$. The future of leadership in Brazil is once again far from certain, and as we all know – markets hate uncertainty! The falling Brazilian Real is prompting higher cash values in Brazil, which is prompting farmer selling, which is in turn pressuring futures prices.

- If one thing is for certain, it is that trading Brazilian politics is a whole lot tougher than trading weather markets! Cash soybean selling in Brazil is prompting some large fund sales in Chicago. US crops are off to a less than ideal start and cold/wet conditions look set to persist into late May. We are struggling tom advocate either side of the market, bullish or bearish, at this time.