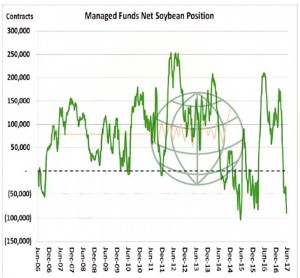

- Funds are back to holding a near record short soybean position that is not going unnoticed. The chart reflects funds holding a sizeable net short position heading into the heart of the growing season. Whether a stout rally develops is in the hand of Mother Nature, but history shows it not unusual to have a few good weather scare rallies during a growing season. We also note that with US and world farmer selling limited by the weak price structure, funds will have to maintain a brisk sales pace to keep the soybean complex under pressure.

- US crop condition has been reported as follows:

- July ’17 wheat futures in Minneapolis have reached two year highs leaving the Chicago bears somewhat more nervous than has previously been the case, and some short covering has been the case. Soybeans continue to attempt to carve out a bottom in the market but the question of whether or not the current warm and dry spell is impacting the soybean crop is leaving many guessing. Consequently, soybeans are following the grains rather than forging their own price path. Kansas wheat has moved strongly above its 50 day moving average and closes above this level will likely trigger fresh fund buying when the market opens. It feels very much as if we have seen the seasonal low in wheat and that the market is awaiting further confirmation of likely 2017 US and world crop reduction prospects. The corn market is also higher, forming a bullish reversal pattern with today’s prices taking out yesterday’s high and low.The market is adding weather premium on drier trends.

- Heavy fund shorts and a twitchy, nervous feel to the markets as warmer and drier conditions appear more established across the Midwest and C Plains leave us somewhat more friendly to the market. Yesterday’s improvement in corn crop rating (see above) is not having a bearish impact as focus is more upon future condition deterioration as soil moisture levels decline. Friday’s USDA report looms close but it is the hot and dry central US forecast that is grabbing the headlines.