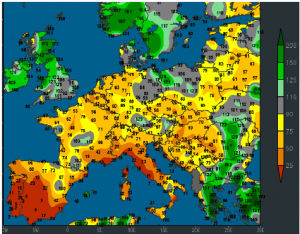

- Although rainfall returned to much of Europe in late May and early June, a below normal rainfall pattern is anticipated going forward with warm to hot temperatures. June is the key month to determine wheat yield and production, and the latest weather forecast hints at declining crop prospects across much of the continent and throughout Ukraine. The 2017/2018 world wheat crop is in decline, which is in stark contrast to a year ago when world yields gained amid favourable weather conditions.

- Spot (July ’17) Chicago corn futures have pushed higher and breached technical resistance at $3.805, which triggered further widespread fund short covering and further price upside.Corn traded volumes have exploded as weekly charts break out to the upside. Wheat and soybeans have followed corn’s bullish lead as Kansas wheat futures lead the way as yield data continues to disappoint as the harvest pushes north. Soybean prices have held back a touch as weakness in the oil portion of the crush limits upside somewhat. We would expect to see a retest of the $9.40-$9.50 level before the weekend basis July ’17 futures.

- It feels as if all Chicago futures markets are adding weather premium right now in advance of anticipated hot, dry and windy forecasts. There is a projection for “blast furnace” like conditions, which will take a toll on central US crops if it materialises.

- Market volumes have been huge today, and this is one potential sign of changing direction – recall our earlier suggestions that we may have seen a market “bottom” – and today could well be another signal that this is under way. Friday’s report continues to loom large over the market but again it is the forecast hot and dry weather that is holding centre stage.