- US crop condition data has been released as follows:

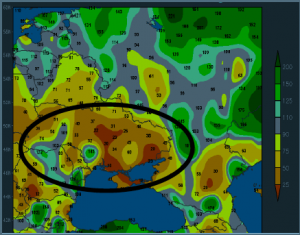

- June is going to end up as being one of the driest/warmest of the past two decades across Ukraine and E Europe. The oval shape in the graphic defines the acute area of dryness that is starting to stress crops. We note that wheat is in its reproductive stage, while corn is 3-4 weeks away from pollination. Rain needs are immediate and with heat forecast next week, crop prospects appear to be heading lower.

- Soybeans began to sell off overnight, and fell at the morning open as weather models added rain and cooler temperatures in near term forecasts, and maintained similar extended outlooks. November soybeans again held resistance against the 50 day moving average overnight and were down 9.75 cents at the close.Traders and analysts have worried over estimated Chinese soybean crush margins, which have been negative since March. Negative margin estimates have little noticeable impact on crush rates, which continue at a record/near record pace. Last week’s crush was estimated at 1.7 million mt, and the cumulative crush figure of 61 million mt is 8% over last year and on pace to reach the USDA’s forecast of 86.5 million mt. To date there has been no indication that imports will slow down, with record large imports expected to continue at least into July. Building soybean meal stocks are becoming a concern. July soybeans have been range bound over the last three weeks, and we doubt that much of trend will develop ahead of next week’s key USDA reports.

- From the perspective of corn, the major weather models are again in agreement that excessive heat will stay isolated to the W Plains through late June, and moderate rain is due across the E Plains and Midwest in the next ten days. This outlook is much more benign that solutions offered last week, and following recent fund short covering some new selling has emerged. Crude also fell to seven month lows, which has triggered a pause in the recent advance in ethanol margins, and ethanol’s premium to gasoline has widened in the last two weeks. It is all US weather near term, and indeed the nearby forecast has improved relative to recent record breaking temperatures across the Plains. Argentine cash basis remains historically low, and so bullish input so far this week has been lacking. We caution against turning overly bullish. Drought will remain firmly in place across the N Plains into early July, and still net drawdown in soil moisture are expected across much of the Corn Belt over the next seven days. Heat (highs in the 90s & low 100s) is forecast expand into Ukraine and Russia beginning late next week.

- US wheat futures settled 3-17 cents higher, led once again by Minneapolis following Monday’s crop update. As noted previously, the US HRS yield in 2017/18 is likely no better than 35-36 bushels/acre, which exacerbates the need to ration high protein supplies, and which places much more pressure on non-US production, Canada’s harvest, specifically. Heat and dryness will persist in W Europe through the remainder of the week, and looks to expand into Ukraine and Russia thereafter. Note that the EU and GFS models have introduced temperature readings in the 90s and low 100s across the Black Sea region beginning next Wed/Thurs. Gulf wheat’s premium to other origins is widening, but the world cash market has largely followed the recent advance in US futures. Notice that only Russian wheat is offered below $190/mt for August delivery, which is equivalent to $4.60/bu, basis September futures and which compares to Black Sea prices in August of last year at $165-175/mt. EU crop estimates are in retreat, and recall roughly half of Russia’s crop is spring wheat.