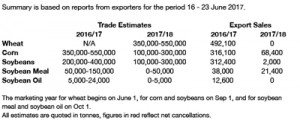

- US export data has been released as follows:

- Chicago futures have been squarely in the green today with wheat undoubtedly the leader as Minneapolis spring wheat responds to the dry and war conditions previously discussed. The US$ has found a nine month low, supporting commodity prices and StatsCan acreage data suggests that spring wheat rationing will not be an easy (or cheap) task.

- StatsCan pegged Canadian spring wheat acres at 6.39 million, down 353,000 from April’s estimate. Winter wheat durum acres were increased slightly but total wheat area was down 311,000 hectares. Dryness, particularly across Saskatchewan is not helping the situation either. The wheat crop looks to be no better that 26-27 million mt compared with last year’s 32 million. Higher protein wheat balance sheets are under pressure.

- Spot Minneapolis wheat futures are up 45 cents at $7.50/bu, and $7.75-$8.00 looks to be the markets next target. This week’s US Drought Monitor has expanded severe drought conditions across the Dakotas and Montana with very little, if any, rain in the next 5-7 days.

- European wheat futures have followed suit and we would anticipate higher cash market prices tomorrow.

- Markets are currently all about weather and supplies going forward, will the 8-15 day weather forecast materialise or be changed in the interim period. The upcoming US 4th July holiday and USDA reports add to the current trepidation that is surrounding markets. Wheat markets look poised to move higher and we are approaching the crucial corn pollination period at a time when the risk of excessive heat is growing across KS, NE and the Dakotas.