- The one fundamental that can change the longer outlook of the world grain market is a declining US$ (Index). The US$ has fallen nearly 9% from the end of 2016 and is now in a position to test the 2015 lows. A close below 92.00 would argue that a longer term bear market is in the making. The fall in the US$ pressures profit incentives for farmers outside the US. Longer term, this slows world acreage expansion and allows demand to catch up with production.

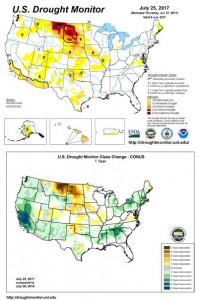

- This week’s drought monitor included modest improvement in parts of SD, but the overall area in drought expanded for the 9th consecutive week. The graphic displays current conditions, as well as changes from last year. Cooler temperatures lie in the offing, but the lack of precipitation into early August will allow for further drought expansion in the near term. Note that where drought is most severe, bouts of heat will likely persist. The forecast today is little changed from prior runs and still features normal temperatures, but well below normal precipitation over the next 10 days. As previously mentioned, the strongest part of high pressure ridging moving forward will be confined to the Southwestern US, but weak high pressure will be more expansive over the next week. Heavy isolated, and welcomed, showers will impact the W KS, E OK and the TX and OK Panhandles on the weekend, but precipitation of any kind will be absent from the US Corn Belt into August 5th.

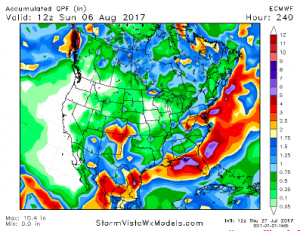

- The EU model’s latest 10-day precipitation outlook is below, and still there is no major pattern shift indicated into the middle part of August. Dryness will also continue across a bulk of the Canadian Prairies through the period. 30-day rainfall totals across the southern half of Saskatchewan and Alberta rest at just 5-40% of normal. Confidence beyond 10 days remains low, but the EU ensemble, which has been the most accurate, indicates a few spits of rainfall across the far Southern Midwest, Delta and Southeast. The Plains and Western Midwest stay dry. Note that US rainfall in the first half of August last year totalled 1.5-3.0”, or some 100- 300% of normal in MN, IA, MO, IL, IN and OH. This does not look to be the case this year, and yield concern will rapidly shift to soybeans if the two-week forecast verifies. Western US drought concern will spread.

- Soybeans traded higher through Thursday, on fresh export sales announcements and a drier extended Midwest weather forecast. At the close, November soybeans were firmly back over $10.00. Weekly export sales were above expectations in old crop and at expectations in new. New crop sales remain behind last year at 5 million mt, while outstanding old crop sales are ahead of last year at 7 million mt.The combined total of 12 million is near unchanged. Old crop exports look to be gaining traction, and the USDA’s daily export reporting system showed old crop export sales of 198,000 mt and new crop sales of 66,000 mt to unknown destinations. Export demand for old crop soybeans looks strong. The market awaits the August crop report, as well as upcoming weather forecasts. The market will continue to add weather premium until there is a clear and defined rain event for the parched N Plains/W Midwest.

- Old crop US weekly export sales were abysmal at just 3.6 million bu, a new marketing year low, as S American exporters ramp up sales and shipments. This will likely remain a theme in weekly sales reports into November. The fact that precipitation in the W Corn belt will be much below normal is well documented, but we would point out that rainfall during this critical growing stage will be just half of what it was a year ago. Along with steep yield loss in the C Plains, work suggests yields below trend in IA as well, and so we doubt the market has fully digested the potential loss of 650-800 million bu of US corn production. The corn market will closely follow the rain prospects for the N Plains and W Midwest. Dryness into mid-August could well cause corn to retest its highs.

- Pictures of floods in Germany, and a pattern of ongoing rainfall there, continue to support high protein wheat cash markets. Fob premiums in the EU and Black Sea are again firmer, and Gulf HRW now holds a sizeable premium to comparable German origin through October, which is noteworthy. The recent break may have been warranted, but the point is at current prices the US is not losing additional export demand. This week’s spring wheat tour has pegged ND’s yield at 38.1 bushels/acre, unchanged from NASS’s July estimate and perhaps a bit below expectations. There is no doubt that yields in the Dakotas and MT will be sharply (20-25%) below trend, but, we mention that historically, the ND crop tour tends to overestimate yield. In only four years since 1995 has the tour’s yield been above NASS’s August forecast. US weekly export sales through July 20th totalled 18 million bu, in line with expectations but some 3-4 million above the pace needed to hit the USDA’s annual target. Falling major exporter production and quality argues for a range of $4.70-5.50, basis September ’17 September futures. Any weakness will very likely be short lived.