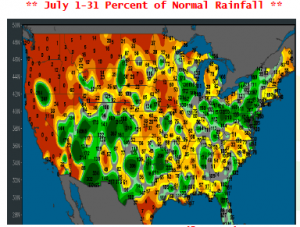

- The month of July is in the record books, and it did not produce the rain or the coverage that was desired. The following map reflects percent of normal rainfall for July. Unfortunately, the drought in the N Plains spread south and east since June 1. An area of above normal rain stretched from N IL into OH and soils here are saturated. The drying across the W Midwest is becoming more pronounced with W Midwest soil moisture at its lowest level since the 2012 drought. Rains are without needed and demanded by growers.

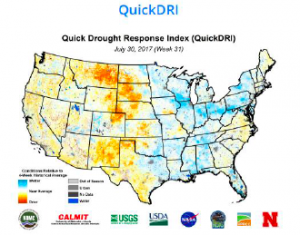

- Overall, the US pattern will be wetter, when compared to July, in the next two weeks, and excessive heat will be absent from all but parts of the C Plains and Dakotas. A pattern shift was due, and coming rainfall will be rather timely for reproducing soybean plants. We would mention that the GFS is still the wettest of the models, and the afternoon run of the EU model is much drier in IL and IA over the next 10 days. Short term drought Index (a running 4-week average) is below. Moisture has improved across the E Corn Belt following recent precipitation. Scattered showers will impact the N Plains and Great Lakes through Friday. Totals are pegged at .25-2.00”, though amounts in excess of 1” will be confined to ND, MN and WI. Note that a fairly robust high pressure ridge will stay intact aloft the C Plains, which will limit further expansion in soil moisture, near term. Heat returns after August 12th.

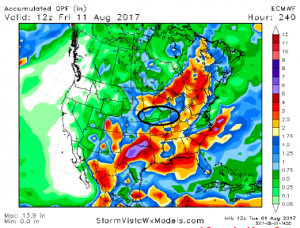

- A more pronounced NW upper air pattern will be established by early next week. The jet stream will then flow directly aloft the N Plains and into the E Midwest, which will act to sustain cooler than normal temperatures across a majority of the Corn Belt and will also allow moisture to flow into much of the Midwest in the 6-10 day period. Better organised precipitation is offered to the S Plains, and perhaps too much rain will fall across TX, OK and parts of LA and AR next Tuesday - Friday. The EU model’s 10-day precipitation forecast is below. IL and IA look to be short changed, but no doubt the worst of this summer’s heat and dryness appears to have passed. Guidance on the 16-30 day period suggests modest warmth may return, but a more normal pattern of rainfall should continue.

- Chicago trade today has been mostly in positive territory although latterly wheat has sagged on spread trade and fund liquidation but with US wheat being the world’s cheapest it is difficult to imagine much downside risk remains right now, particularly with US export demand picking up and stocks in decline. Technical damage to markets was done on Tuesday and this may take some time to heal.

- Rains are falling across N Dakota this morning with the moisture to slide east and slightly farther south in the next 24-36 hours. The rains are nice, but won’t do much if anything to help N Dakota spring wheat or corn. The rain may aid soybeans, but this rain is an interlude, not a change of the pattern to a wetter profile. Dryness returns during the 5-12 day forecast period.

- Brazilian President Temer faces a critical vote in the Congress today in terms of whether it should seek corruption charges or allow Temer to fill out his term until the next presidential election in 2018. The Brazilian Real is slightly stronger at 3.13 vs the US$. The marketplace is expecting that the Congress will move to block a special prosecutor to investigate Temer.

- Additional rain throughout much of Germany and Poland look to further degrade crop quality and quantity. The world’s shortage of high protein wheat is worsening with the wet weather across N Europe. Most commercial sources are reducing the EU all wheat crop by another 2-3 million mt to 143-145 million vs. the WASDE estimate of 150 million mt. WASDE should reduce world wheat production by at least 8-10 million mt in next week’s report due to falling world wheat production. What will be missed is the growing shortage of high protein/durum wheat.

- In summary, the market is healing from yesterday’s technical wound and a few days of back and forth trade is needed before traders can decipher if fund managers have cut back enough on their length heading into the August WASDE report. The US$ is now at a 15 month low and Russian farmers have shut the doors on cash wheat sales during the harvest.