- US Export data has been released as follows:

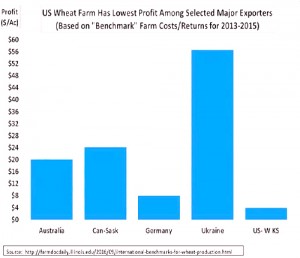

- The Black Sea will produce record amounts of wheat this year, and producers there are planning to expand again next year. The record high yields and current depressed price is producing considerable profitability. The chart below reflects wheat profitability of some of the world’s largest producers. Notice the big profit gains that are being scored by Ukraine farmers of nearly $56/acre compared to just $4/acre for the US farmer. The trend to fewer US wheat acres will consequently likely continue in the years out amid high costs and low returns.

- Soybean and product markets traded higher through Thursday. Soybean meal led markets higher as funds unwound long oil/short meal spreads, and strength in the product markets lifted November soybeans to the best close since the August USDA crop report. Chinese end users were targeting new crop soybeans under $9, and were unwilling to chase the market higher on the summer rally. However, with November beans $1 under the summer high, China has been an active buyer. The market anxiously awaits the results of the Farm Journal Crop Tour, but after a more than $1 break from the summer high, a yield under 48 bushels/acre would confirm an early seasonal low. The FJ Tour yield is expected this evening.

- Fresh news in corn is once again absent, and the market anxiously awaits Farm Journal’s official US yield forecast, which we have noted is a fairly good indicator of NASS yield changes in September. Export sales were unexcited, though we do mention that as S American exporters find record demand, cash basis there continues to inch higher, and Brazilian and US origin are again offered at parity on nearby delivery. Competition for world trade will be very steep into late year, and while the Gulf market is better positioned to compete with S America, export demand will likely not be a feature of the 2017/18 crop year. Brazil has approved a 20% tax on ethanol imports from the US. US ethanol shipments to Brazil in the first half of the year are record large, and on the margin this will slow demand. Still, US crude demand is much stronger than in recent years, ethanol production margins remain elevated and even blending margins have rallied substantially since mid-month.

- US wheat futures ended higher, EU futures ended steady, and chart action suggests a seasonal bottom was scored this week, and certainly the time is right. US export sales were in line with trade estimates, though over time we look for a decent boost in demand, and amid strength in the €uro today US Gulf wheat is still highly competitive through late autumn. Recall that, amid an adjustment to abandonment, spring wheat production in Sep will likely be lowered another 15-25 million bu and the goal is still to slow US HRS demand. US wheat at current prices will continue to find non-traditional interest, with Gulf wheat this evening cheaper than all but lower protein Black Sea origin. Despite ENSO trending toward a weak La Niña by late autumn, the near term rainfall outlook in Australia has failed to improve. Guidance on September’s pattern still indicates normal/above normal rainfall, but operational models are void of moisture through September 7th. Critical growing stages are due very soon thereafter, and precipitation since July 1 in S Australia, New South Wales and Queensland rests at just 25-50% of normal. A demand-led recovery lies in the offing, and Russian exports so far have not kept up with the USDA’s annual forecast.