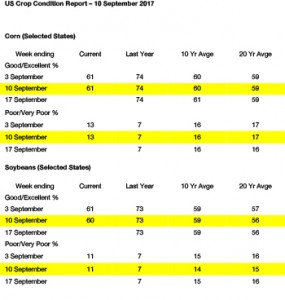

- US crop condition data has been released as follows:

- Monday was a mixed day of trade, with soybeans back and forth around unchanged before ending 2 cents lower. Soybean product markets were mixed through the day with meal leading the complex lower, while soybeanoil followed palm oil futures higher following the monthly Malaysian palm oil report. The Malaysian Palm Oil Board reported August palm oil production was down slightly from July, while exports were above expectations and at a three month high. End of month stocks fell short of expectations, and November palm oil rallied following the report release to the best close since January. After the close, NASS reported national soybean crop ratings at 60% good/excellent versus 61% last week, and 73% a year ago. National good/excellent ratings have been stable, despite rainfall totals across the Cornbelt that have been well below normal in the last month. The key figure in Tuesday’s crop report will be the implied pod weight used to forecast yield. Our outlook stays bullish on sharp breaks amid building Chinese demand and a view that crop size estimates will decline in upcoming USDA reports.

- Corn futures simply marked time ahead of tomorrow’s yield updates. Crude recovered modestly from Friday’s losses. US crop conditions this week are unchanged. By-state ratings were fine-tuned marginally, but otherwise national good/excellent ratings through the remainder of the season are not expected to change from 61% currently, vs. 74% a year ago. Analysis of crop conditions, Pro Farmer data, and other tours of the Midwest suggest yield will be down, but only 1-3 bu/acre by Oct/Nov. Old crop exports will be raised 50-100 million bu on Tuesday, but otherwise the updated US balance sheet will be fairly unexciting. It’s unlikely that end stocks fall below 2,000 million bu, which in turn keeps fair value at $3.40-3.90, basis December futures. We do mention that global feed wheat prices have rallied some $5/mt in the last three weeks, and unlike a year ago Gulf corn is offered at a discount to EU/Black Sea wheat. This will aid corn demand as a whole, but there are still a few months in which S America will dominate trade. Both bulls and bears will struggle for leverage unless actual yield data is surprisingly low.

- US and European wheat futures both ended lower. In the US weakness is a function of a lack of any news, and talk of better than expected spring wheat yields in Canada. In Europe, exports continue to suffer and news today that Egypt has rejected a cargo of French wheat due to quality issues is viewed as further limited demand. Russia looks to dominate sales to Egypt over the next several months. The US$ rallied, and so far the US$ Index has held support at 91 points. US winter wheat planting through to Sunday reached 5% complete, vs. 6% on average, and amid upcoming rainfall planting looks to accelerate in late Sep/early Oct. The Black Sea fob market is again slightly firmer this week, with Russian offered through Nov at $185-187/mt. Comparable Gulf HRW is quoted this evening at $192-194, which is competitive but Russia will easily be the world’s dominant exporter through thisautumn. The Russian market very likely bottomed in late August, but longer term Russia fully aims to expand wheat production and exports, and a major drought is needed to really alter the structure of the market. Tuesday’s WASDE will have only limited US wheat changes, as USDA will wait for NASS’s Small Grains Summary due at the end of the month.