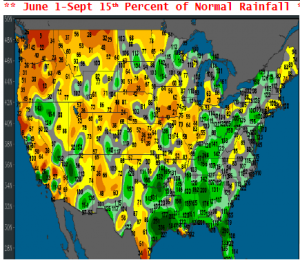

- Call us old fashioned if you like, but the assumption may be wrong and we continue to argue that water is one of the main ingredients to grow a trend or above trendline yield US corn or soybean crop. The map below reflects percent of normal rainfall since June 1st, the real start of the growing season. 40% of the Midwest and Plains received less than 60% of normal rain since June 1. Historically, such lack of water produces a below trend yield. NASS continues to say above trend, and we will have to await actual harvest yield data to solve/end this debate.

- Soybeans traded higher overnight, and extended gains through midweek trade. The market broke lower at the report release on Tuesday on a larger than expected yield/crop size, but further review of the USDA’s assumption of a record heavy pod weight has cast doubt on September estimates. At the close November soybeans were 10 cents higher and back above the 100 day moving average. Crop size and yields were the key numbers in Tuesday’s WASDE report, though the USDA also made significant changes to the soybean oil estimates. Following the Commerce Dept’s ruling against Argentine and Indonesian biodiesel imports, the USDA raised their estimate of 2016/17 soybean oil for biodiesel demand by 50 million lbs to a record large 6,050 million lbs. Soybean oil demand for biodiesel in 2017/18 was increased by 1,050 million lbs. This means that 31% of US soybean oil production will be used for biodiesel versus 28% in 2016/17. Our view for the soybean market stays bullish, as we look for a US soybean yield closer to 47 bushels/acre, while we expect Chinese demand to develop on corrections ahead of harvest.

- Corn traded higher overnight and was positive through most of the day, though late day selling put December through to May contracts back to unchanged at the close. The latest update to the Brazilian corn lineup shows just over 1.7 million mt have sailed in September, with another 3.2 million that are scheduled to sail by months end. If realised, total exports of 5 million mt would be just under August exports, but still more than double last year and the largest September export figure on record. Cumulative Mar- Feb exports at just over 15 million mt would also be a record shipment pace. Brazil is in the process of shipping out a monster crop, though the USDA has already accounted for slower US exports in its balance sheet, with US trade to fall 19%. We remain neutral corn, with downside risk limited ahead of harvest. The market awaits actual harvest results to determine if the USDA’s yield is still too high.

- Wheat futures were mostly higher with the Chicago Sep contract up 6 cents; the KC Sep contract closed up 5 cents while the MGE old-crop contracts were up from 2-3 cents. In the September WASDE, despite strong exports to date and competitive prices, USDA did not raise its projection of US exports primarily because of the record size of the exportable surplus of wheat from the “Black Sea” exporters. In order to achieve the USDA’s projection for combined record exports of 56.6 million mt, these countries will have to, on average, export a record quantity in each of the ten months remaining in the Jul-Jun marketing year. Global wheat prices appear to be bottoming and will rally if problems arise with Black Sea logistics or on further losses in the Argie and/or Aussie crops.