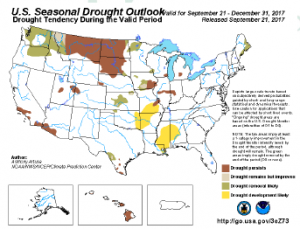

- NOAA’s updated climate forecasts today included ongoing normal/above normal temperatures through December, and mostly dry weather across the Central US over the next 45 days. The odds of La Niña developing in late autumn/winter were boosted noticeably (62%, vs. just 26% last month), and overall drought is expected to persist/expand across the Plains. The US drought monitor this week featured class reductions in MT, ND and MN, but an expansion in abnormal dryness in MO, IA, IL, IN and MI, which provides evidence that NASS’s yield estimates are overstated. Heavy rains lie in the offing Sunday to Tuesday across the Plains, but no precipitation of note is forecast east of the MS River. Temperatures into the weekend will reach as high as the upper 80s and 90s. The return of a broad NW upper air flow will allow dry weather to return to the whole of the Central US Sep 28-Oct 5, accelerating crop maturity and harvesting.

- Soybeans closed firm on Thursday while soy products were sharply mixed. Soymeal led the Chicago soybean markets higher and finished back above both the 50 and 100 day moving averages, supporting the soybean trade while soybean oil marked the lowest close in nearly a month. US soybean export sales were well above expectations at just over 2.3 million mt, the largest since last October. Soybean oil sales remained light in both old and new crop positions. The soybean oil market bottomed in early June and has trended higher since, as the market anticipated that the government would intervene to slow foreign biodiesel imports, and export sales have slowed since the Commerce Dept’s announcement in August. New crop sales sit at a decade long low, while outstanding old crop sales are the lowest since 2012/13. With domestic biofuel demand to increase nearly 1billion lbs (16%) to 7 billion lbs in the year ahead, US exports are seen sliding to a three year low. Firm trade is expected ahead of the weekend, with a close over $9.80 to spark a round of technical buying.

- Chicago corn futures again did very little, and enthusiasm is lacking with the harvest quickening. Soaking rains will impact a majority of the Plains and NW Midwest early next week, but otherwise the 30-day outlook features warm/dry weather. A flood of combine data is becoming available. Early yield data has been highly variable. US export sales through the week ending Sep 14th totalled 21 million bu and featured moderate sales to Japan and Mexico, but no other surprising destinations. Total 2017/18 commitments rest at 434 million, and an average weekly pace of 28 million bu is needed to hit the USDA’s annual target. Export demand certainly won’t be a major factor into early 2018, and work suggests the USDA’s forecast is 50-100 million bu too high. Otherwise, fresh news is lacking. Whether December can find support above $3.55 will be important in the near term. There is fundamental support in wheat (rising world cash markets, less than ideal weather) and in soybeans (demand/Midwest yield), but corn lacks much excitement. Brazil remains abnormally dry, but it’s far too early to be too pessimistic on the first crop.

- US wheat futures rallied slightly for a third consecutive session, and December Chicago settled above major technical resistance at $4.52, albeit very slightly. Russian fob offers are unchanged, EU offers are noticeably higher though, and with managed funds still short an estimated 85,000 contracts in Chicago, downside risk requires an improvement in world weather. Western Australia will benefit from moderate rainfall in the next ten days, but elsewhere only spotty precipitation is forecast into early October, certainly not enough to reverse the trend of declining soil moisture. There is also more attention being paid to recent and upcoming dryness in E Ukraine and Russia, assuming the current two-week outlook verifies, September rainfall in the Black Sea will rest at just 20-70% of normal, and large pockets of Ukraine and S Russia will see just 20-30% of normal rain in September. US weekly export sales were a meagre 11 million bu, unchanged from last week and some two million shy of what is needed to meet the USDA’s annual forecast. The US’s share of world trade is suffering as record shipments leave Russia, but US exporters have much better export opportunities beyond Nov/Dec.