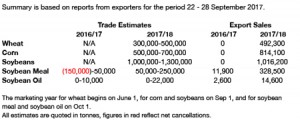

- US export data has been released as follows:

- Chicago markets are mostly higher through to midday on expectations of large Chinese demand returning next week together with less than stellar yield reports so far this week. Weekly export data showed better than anticipated volumes for wheat and corn, but lower figures for soybeans. Expectation is that commercial interest in soybeans will grow during October as river water levels rise and Chinese demand picks up.

- The US$ is higher today and crude oil is also making gains, spot prices reaching $51.00/barrel. Informa Economics, in its monthly update raised US corn and soybean yields, albeit very slightly. Corn yield is now pegged at 170.5 bushels/acre, vs. 169.7 in September and the USDA’s 169.9. Soybean yield is forecast at 50.0 bushels/acre, vs. 49.9 in September and the USDA’s 49.9. Whether corn yield is between 166-170 bushels/acre won’t much affect the US balance sheet, but even small changes in soybean yield are important. We maintain a yield forecast of 48 bushels/acre, and key will be combine reports from later planted crop in the E Midwest, where in much of IL, WI, IN and MI just 20-30% of normal rain fell in August and September.

- Russia’s Ag Ministry has pegged the wheat crop there at 81.4 million mt, vs. the USDA’s 81. This is not an official estimate, but we do mention that interior Russian wheat prices last week firmed just a bit. Updated interior prices on Friday will be watched closely. We would expect tomorrow’s CFTC report to include a net fund short in corn worth 145,000 contracts, up 12,000 on the week; a net short in Chicago wheat worth 70,000, up 5,000 on the week, and a fund net long in soybeans of 30,000, up just marginally on the week. Funds’ short position in corn has expanded some 80,000 contracts since late August. US corn stocks are high, and the Oct WASDE won’t do much to change this, but the spec community is already positioned for this.

- We maintain a broadly neutral outlook, but following last week’s stocks report, a US soybean yield of 49 bushels/acre (plus) must be confirmed for any break in price to be sustained. Central Brazil will stay rather dry over the next 10 days.