- HEADLINES: Chicago steady/higher at midday; Press release surrounding dairy cow disease expected; GFS weather forecast wetter in N Brazil.

- Chicago grain futures are steady/higher at midday in a reversal of Friday the volume of trade has been active with short covering being featured.

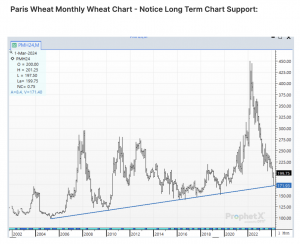

- Wheat and soy futures have been the bullish leaders on the Russian political battle between the Kremlin and a private exporter, RIF. 4 cargoes of RIF wheat are said to be held at ports awaiting phytosanitary certificates. Russian wheat is offered at $210/mt and most recently traded on Friday at $206/mt. The next level of resistance is the 50-day moving average which crosses at $5.775 basis May Chicago futures.

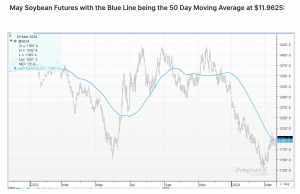

- For the fourth day in a row, soybean futures have pushed either side of the 50-day moving average with soyoil futures forming a reversal. There is no big news for Chicago soybeans other than Brazilian soybean exports for March are forecast to be the second or third largest on record. Brazilian soybean export commitments are the third largest on record which is offering the cash market support.

- Corn futures have been unable to gain any upside traction with active wheat/corn and soybean/corn spreading. Traders find it difficult for Thursday’s report to be overly bullish with the US holding 2.0 billion bu of corn supplies and stocks being over 1.0 billion bu larger than last year.

- Chicago brokers estimate that the managed money has bought 5,300 contracts of soybeans, 4,700 contracts of soyoil, and 1,200 contracts of soymeal. In the grains funds are flat in corn while buying 5,600 contracts of wheat.

- US weekly export inspections for the week ending March 21 were 48.3 million bu of corn, 28.2 million bu of soybeans and 11.6 million bu of wheat. For their respective crop years to date, the US has exported 961 million bu of corn (up 242 million or 25%), 1,342 million bu of soybeans (down 309 million or 19%), and 520 million bu of wheat (down 93 million or 15%). We look for WASDE to raise their 2023/24 corn export forecast by 25-50 million bu and cut soybean exports by 15-25 million bu in April.

- The US dairy industry is awaiting a USDA press release that is rumoured to tie HPAI (avian flu) to dairy cattle in several Southern Plains operations that have had cows go off feed and nearly dry up due to illness. The mortality rate of the illness has been low, but milk production declines and fails to recover in some older animals. The disease has been a mystery and previously blamed on bad feed and the smoke from recent prairie fires. The US dairy industry has been aware of the mystery illness for 10 days, but only now USDA will be having a comment. We have no knowledge of what the USDA will say or what is the remedy. Also, a Minnesota goat has also been infected with an avian flu type of disease which was reported last weekend. We currently doubt that the mystery illness will have a significant impact on grain or feed consumption, but additional information is required. This is something new to monitor.

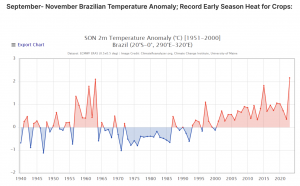

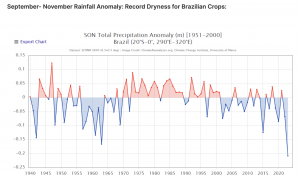

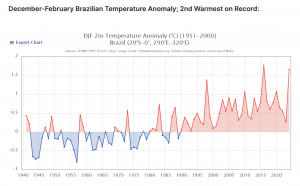

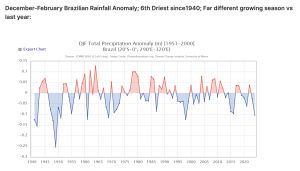

- The midday GFS weather forecast is again wetter in Mato Grosso and far Northern Brazil, with accumulation there into April 4 raised to 3-5”. Scattered showers will persist across N Brazil into April 5-6, and so the GFS forecast has extended the duration of this wet pattern. The GFS and EU models are at odds over early April rainfall in N Brazil, but safrinha corn crop threats nearby remain confined to Mato Grosso do Sul and Parana, where 30-day rain has been recorded in a range of just 30-50% of normal, and where a pattern of below normal rain is forecast to continue. Mostly dry and warmer than normal temperatures in Argentina facilitate active harvesting.

- Recall there remains an 8.1 million mt spread between CONAB and USDA’s estimate, which matches nearly exactly projected US end stocks. Key is whether new weekly soy sales of 10-15 million bu/week continue into the latter part of April. Yet, be prepared for additional choppiness into Thursday. USDA’s first pass at the 2024 US acreage matrix is important. Snow/cold in the north and unrelenting/unwanted rainfall in the Delta/Southeast will be more closely monitored beyond April 1.