- The US has issued its latest weekly export data as follows:

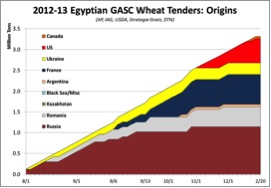

Wheat; 524,800 mt which is within estimates of 400-600,000 mt.

Corn; 512,600 mt which is above estimates of 350-450,000 mt.

Soybeans; 1,171,000 mt which is above estimates of 750,000 – 1,000,000 mt.

Soybean Meal; 274,600 mt which is within estimates of 150-300,000 mt.

Soybean Oil; 4,700 mt which is below estimates of 15-30,000 mt.

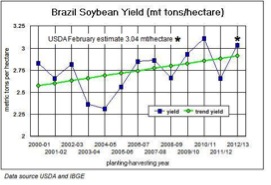

- In Brazil’s top soybean producing state, Mato Grosso, there are still fears that the periods of intense drought which have been experienced may well jeopardise output. 4 to 8 inch moisture deficits and rainfall barely hitting 50% of normal were experienced throughout late 2012. Although January rains did increase significantly the conditions which followed in February were uneven with extended dry periods lasting 10 days or more. It must be borne in m ind that this is very unusual in the tropics where daily rains are the norm and the high daytime temperatures dry out topsoils rapidly. Late planted crops which are in their pod filling growth stage will be most affected.

- One commentator has suggested that the crop does not feel like a record this year despite the 10% increase in acreage. The USDA’s latest forecast is for a crop of 83.5 million mt, others are pitching lower numbers ranging from 81 to 82 million mt.

- The US corn belt has benefitted from the recent snowfalls leaving an excess of soil moisture when compared to normal. For crop land to maximise the benefit from the snow an orderly and steady melt would be ideal; latest forecasts seem to be providing just that, a gradual warming with daytime temperatures above freezing and nighttime temperatures falling below. The early outlook is, for once, showing some some improvement.

- In Australia the wheat planting season, which begins in May and runs through June, is approaching. For crop prospects to look good, eastern Australia will need significant heavy rainfall to replenish drought parched land which has resulted from last year’s drought. New South Wales and Victoria also have serious moisture deficits in their soils. The southeastern wheat regions look better with rainfall and soil moisture close to average at this time.

- We have heard that Germany has purchased 60,000 mt of feed wheat from Brazil, due to arrive in a few weeks; maybe this is a sign of things to come as a consequence of the furious EU export pace seen this season.

- Talking of which, Brussels issued a further 455,000 mt wheat export licences this week, which brings the season total up to 14.554 million mt; this compares with 11.159 million mt at the same time last season. The additional 3.395 million mt represents an increase of 30.4% year on year, which is slightly lower than last week’s gains but still a huge increase which looks as if it will create an issue at the end of the season if it continues.