- A look back over recent years data show that in the days following the March stocks and seeding report markets have a strong tendency to some extreme volatility, the difficulty is in objectively picking the correct direction! Bullish, or bearish, which way will it go tomorrow? One level of difficulty which we face here in Europe is that by the time we digest the figures the game will be over and the sop shut for a four day weekend as Ester kicks in. By the time we return on Tuesday it will all be old news and markets will have reached their new trading levels.

- Trade estimates for the March 1st stocks are as follows (billion bu):

Average Range

Corn 5.030 4.916 – 5.248

Soybeans 0.947 0.912 – 1.059

Wheat 1.167 1.010 – 1.238

- Interestingly, the spread of estimates is biggest in corn with 332 million bu, followed by wheat at 228 million bu and soybeans bringing up the rear at 147 million bu. Clearly, with such a range there are going to be winners and losers as with all markets and we await tomorrow’s report with interest.

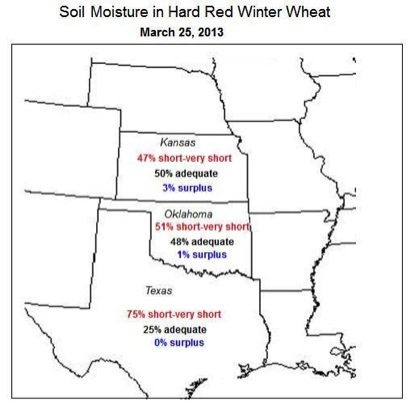

- US hard red winter wheat producers in the top three states report a worsening of crop condition with 27% reaching good/excellent and 34% poor/very poor with 39% reported as fair. Soil moisture has declined in recent weeks with little rainfall in the region in the last fortnight. It appears that Texas has seen particularly arid conditions as growers report 75% short or very short of topsoil moisture.

- Drought at this time is particularly bad for wheat crop development as the plant is jointing and in need of ample soil moisture to assist development of essential flag leaf formation in coming weeks. Added to the soil moisture issue, the recent cold snap has hit plants well past dormancy, and as such more susceptible to damage. It is highly possible that secondary tillering, if it occurs, will compensate for current damage, but if we have a repetition of these cold conditions the resultant damage is likely to be more permanent and yield reducing.