- Still digesting USDA numbers, grains currently down and soybean complex higher, and will update later but meanwhile today’s headline data is as follows:

World 13/14 wheat ending stocks: 176.28 million mt, above estimate of 172.76, and 172.99 month on month.

US 13/14 wheat ending stocks: 561 million bu, above estimates of 551 and 551 month on month.

World 12/13 corn ending stocks: 122.59 million mt, below estimates of 122.798, and 123.11 month on month.

World 13/14 corn ending stocks: 151.42 million mt, above estimates of 146.927and 150.17 month on month.

US 12/13 corn ending stocks: 661 million bu, below estimates of 718 and 719 month on month.

US 13/14 corn ending stocks: 1.855 billion bu, above estimates of 1.732, and 1.837 month on month.

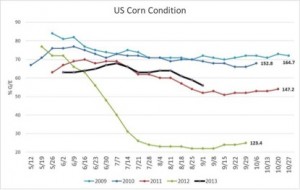

US 13/14 corn production: 13.843 billion bu, with 155.3 bu/acre, on 89.1 million harvested acres, above estimates of 13.62/153.69/88.559 and above 13.763/154.4/89.1 month on month and up from 10.78/123.4/87.4 year on year.

World 12/13 soy ending stocks: 61.55 million mt, below estimates of 61.73, and 62.22 month on month.

World 13/14 soy ending stocks: 71.54 million mt, above estimates of 71.167 and below 72.27 month on month.

US 12/13 soy ending stocks: 125 million bu, above estimates of 123 and unchanged month on month.

US 13/14 soy ending stocks: 150 million bu, below estimates of 165 and 220 month on month.

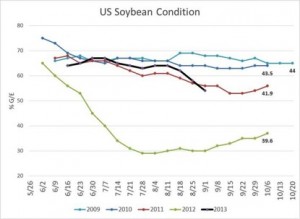

US 13/14 soy production: 3.149 billion bu, with 41.2 bu/acre, on 76.378 million harvested acres, above estimates of 3.14/41.172/76.248 and below 3.255/42.6/76.4 month on month and up from 3.015/39.6/76.1 year on year.

- The USDA has today released its weekly export figures as detailed below:

Wheat: 551,900 mt, which is within estimates of 450,000-650,000 mt.

Corn: 332,600 mt, which is below estimates of 400,000-500,000 mt.

Soybeans: 478,100 mt, which is below estimates of 650,000-800,000 mt.

Soybean Meal: 128,700 mt, which is within estimates of 70,000-230,000 mt.

Soybean Oil: 6,200 mt, which is below estimates of 10,000-20,000 mt.

- Brussels this week has granted wheat export licences totalling 724,008 mt, which brings the season total up to 5,409,530 mt. This is nearly 2.6 million mt ahead of this time last season (92% ahead).

- One last news item from Reuters suggests that the EU will cap fuels from food crops (wheat and rapeseed) as fears for rising food prices and climate damage continue to grow. The suggested 6% ceiling on inclusions fall some way short of the 10% target set in 2009. EU biofuel producers will no doubt feel hard done by with any expansion prospects effectively curtailed. From a personal perspective it is pleasing to see the EU agreeing with our long held view on the folly of bio-fuels; we have long held the opinion that they are not energy neutral! In 2007 EU ethanol production was around 2.7 billion gallons, today around twice that. According to latest estimates, the EU wastes around 5 billion gallons of car fuel each year due to ……….. (would you believe) ……. Incorrect tyre pressures. Maybe they should legislate on that instead!